Unlock The Power Of Cryptocurrency Data: Unleash Your Investing Potential Today!

Cryptocurrency Data

Introduction

Hello Friends,

1 Picture Gallery: Unlock The Power Of Cryptocurrency Data: Unleash Your Investing Potential Today!

Welcome to this article on cryptocurrency data. In this increasingly digital age, cryptocurrencies have gained immense popularity. Their decentralized nature and potential for high returns have attracted investors from all around the world. However, to truly understand and capitalize on the opportunities in the cryptocurrency market, it is crucial to have access to accurate and reliable data.

In this article, we will explore the importance of cryptocurrency data, its sources, and how it can be utilized for making informed investment decisions. So, let’s dive in and explore the fascinating world of cryptocurrency data together!

What is Cryptocurrency Data? 📊

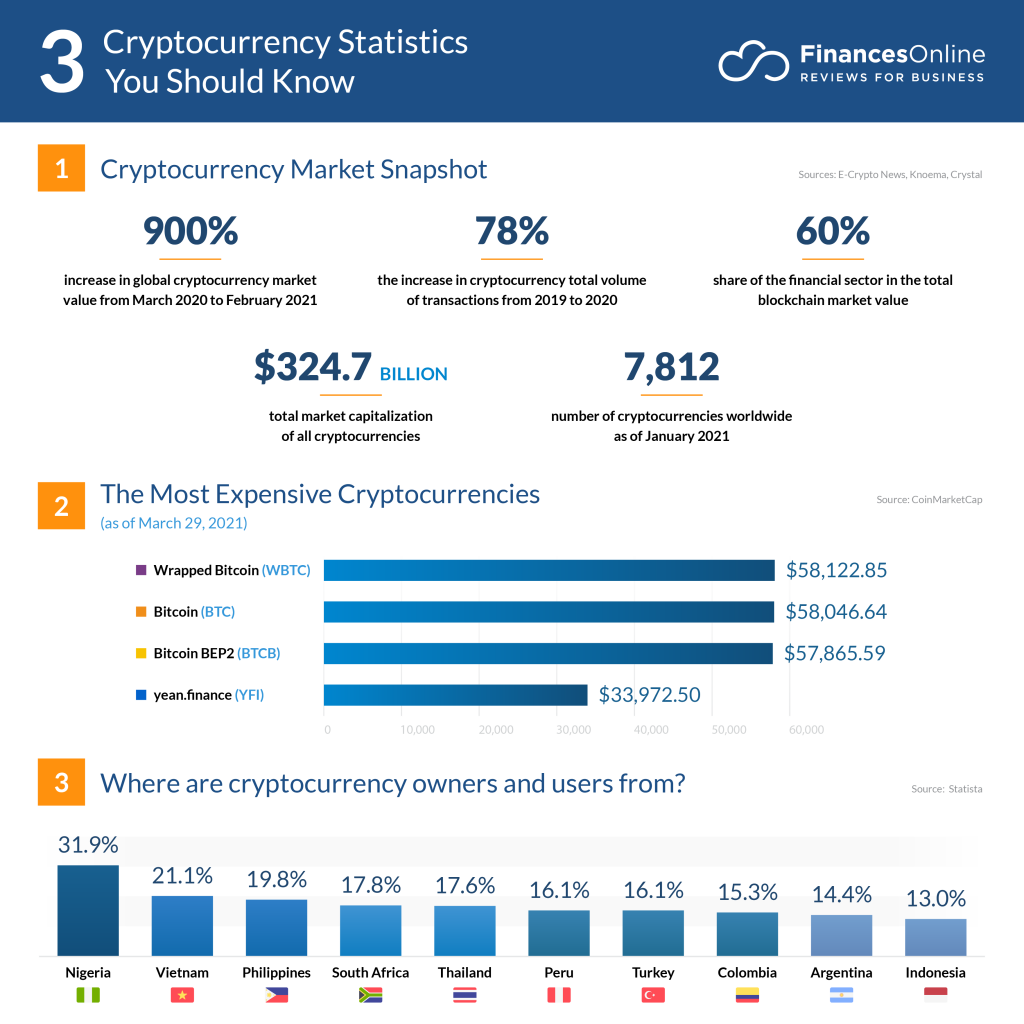

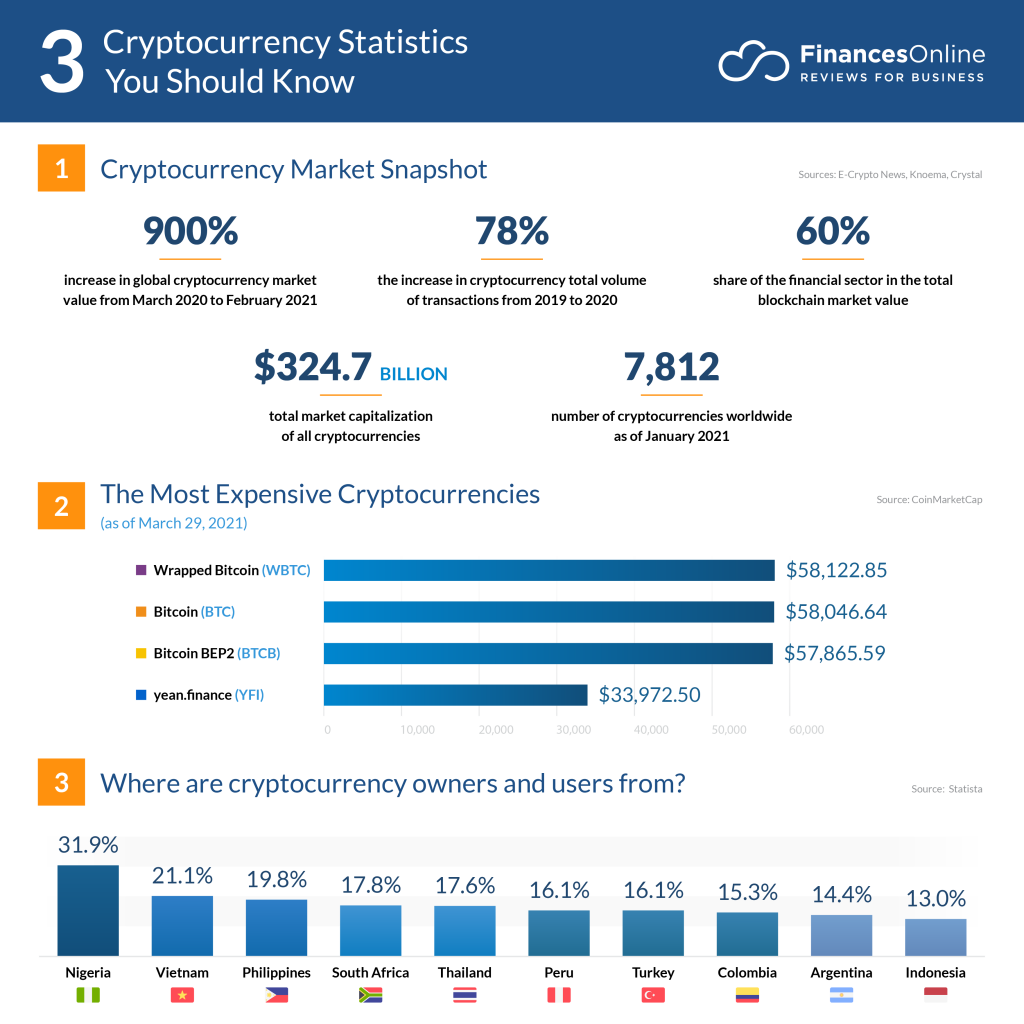

Image Source: financesonline.com

The term cryptocurrency data refers to the information and statistics related to various cryptocurrencies available in the market. It encompasses a wide range of data points, including historical prices, trading volumes, market capitalization, and more.

With thousands of cryptocurrencies in existence, each with its own unique features and value proposition, having access to comprehensive and accurate data is crucial for investors, traders, and enthusiasts. Cryptocurrency data enables users to make informed decisions, analyze trends, and identify potential investment opportunities.

Who Provides Cryptocurrency Data? 📈

Cryptocurrency data is provided by a variety of sources, ranging from dedicated cryptocurrency exchanges to specialized data providers. Some popular platforms that offer cryptocurrency data include CoinMarketCap, CoinGecko, and CoinCap.

These platforms aggregate data from various exchanges and provide real-time information on prices, trading volumes, and market trends. Additionally, they offer advanced features such as historical data analysis, portfolio management tools, and customizable alerts.

When Should You Utilize Cryptocurrency Data? ⏰

The utilization of cryptocurrency data is not limited to any specific time. Whether you are a seasoned investor or a beginner, cryptocurrency data can be utilized at various stages of your investment journey.

When considering investing in a particular cryptocurrency, analyzing its historical price trends and market performance can provide valuable insights. Similarly, tracking the trading volumes and market capitalization of cryptocurrencies can help identify emerging trends and assess market sentiment.

Furthermore, cryptocurrency data can be used for technical analysis, such as identifying support and resistance levels, trend patterns, and indicators. This analysis can assist in making informed decisions about buying, selling, or holding specific cryptocurrencies.

Where to Access Cryptocurrency Data? 🌍

To access cryptocurrency data, you can visit various online platforms that provide real-time and historical information. As mentioned earlier, platforms like CoinMarketCap, CoinGecko, and CoinCap are popular choices.

Additionally, most cryptocurrency exchanges offer their own data APIs (Application Programming Interfaces), allowing developers and users to access real-time trading data directly from the exchange. These APIs provide a wealth of information, including order book data, trade history, and market depth.

Moreover, there are numerous data analysis tools and platforms available that offer advanced features for analyzing and visualizing cryptocurrency data. These tools can help you gain deeper insights into the market and make more informed investment decisions.

Why is Cryptocurrency Data Important? ❓

Cryptocurrency data plays a pivotal role in the world of digital currencies. Here are some key reasons why it is important:

Market Analysis: Cryptocurrency data allows investors to analyze market trends, identify patterns, and make informed decisions based on reliable information.

Investment Opportunities: By analyzing historical data and market performance, investors can identify potentially profitable investment opportunities and make calculated decisions.

Risk Management: Cryptocurrency data helps investors assess the risk associated with different cryptocurrencies, enabling them to make informed choices and manage their portfolios effectively.

Price Tracking: Real-time data allows users to track cryptocurrency prices and fluctuations, enabling them to execute trades at the most favorable prices.

Regulatory Compliance: Cryptocurrency data helps regulatory bodies monitor and enforce compliance in the cryptocurrency market, ensuring transparency and security.

How Can Cryptocurrency Data Be Utilized? 🚀

Cryptocurrency data can be utilized in various ways to enhance your investment strategies and decision-making process. Here are some common use cases:

Portfolio Management: By analyzing the performance of different cryptocurrencies, users can efficiently manage their portfolios and optimize their investment allocations.

Trading Strategies: Cryptocurrency data can be used to develop and test trading strategies, allowing users to take advantage of market opportunities and maximize their profits.

Research and Analysis: Researchers and analysts can leverage cryptocurrency data to study market trends, evaluate the impact of news and events, and generate valuable insights.

Price Prediction: Advanced data analysis techniques, such as machine learning and artificial intelligence, can be applied to cryptocurrency data to predict future price movements with a certain degree of accuracy.

Risk Assessment: Cryptocurrency data can help investors assess the risk associated with different cryptocurrencies, enabling them to make informed decisions and mitigate potential losses.

Advantages and Disadvantages of Cryptocurrency Data 💹

Like any other tool or resource, cryptocurrency data has its own set of advantages and disadvantages. Let’s explore them in detail:

Advantages

Accurate Information: Cryptocurrency data provides users with accurate and reliable information, allowing them to make informed decisions based on real-time market conditions.

Transparency: By making cryptocurrency data easily accessible to the public, it promotes transparency in the market and minimizes the information asymmetry between market participants.

Opportunity Identification: Cryptocurrency data helps investors identify emerging trends, new investment opportunities, and potential market inefficiencies.

Diversification: With access to comprehensive data, investors can diversify their portfolios effectively by analyzing the performance of different cryptocurrencies.

Automation: Cryptocurrency data can be integrated with automated trading systems, allowing users to execute trades based on predefined strategies and parameters.

Disadvantages

Data Manipulation: As with any form of data, there is a risk of manipulation or inaccuracies. Users must ensure they are sourcing data from reliable and trustworthy platforms.

Overwhelming Amount of Data: The vast amount of available cryptocurrency data can be overwhelming, making it challenging to extract meaningful insights without the right tools and analysis techniques.

Dependency on Technology: Cryptocurrency data relies heavily on technology infrastructure, making it susceptible to technical failures, cyber attacks, and other vulnerabilities.

Market Volatility: Cryptocurrency markets are highly volatile, and relying solely on historical data may not accurately predict future market movements.

Regulatory Challenges: The regulatory landscape surrounding cryptocurrencies is still evolving, which can introduce uncertainties and potential risks for users relying on cryptocurrency data.

Frequently Asked Questions (FAQs) ❔

Q: Can cryptocurrency data help predict the future price of cryptocurrencies?

A: While cryptocurrency data can provide insights into historical price trends, predicting the future price of cryptocurrencies remains highly speculative and challenging.

Q: Are there any free sources of cryptocurrency data available?

A: Yes, there are several platforms that provide free access to cryptocurrency data, but they may have limitations in terms of data depth and analysis tools. Premium platforms often offer more comprehensive data and advanced features.

Q: How often is cryptocurrency data updated?

A: Most platforms provide real-time or near-real-time updates for cryptocurrency data. However, the frequency of updates may vary depending on the platform and the specific data being tracked.

Q: Is cryptocurrency data reliable for making investment decisions?

A: Cryptocurrency data is a valuable tool for making informed investment decisions. However, it should be complemented with other forms of analysis, such as fundamental research and market trends, to minimize risks.

Q: Can cryptocurrency data be used for tax reporting purposes?

A: Yes, cryptocurrency data can be utilized for tax reporting purposes. It provides the necessary information to calculate gains, losses, and other tax obligations associated with cryptocurrency investments.

Conclusion

In conclusion, cryptocurrency data plays a vital role in the world of digital currencies. It provides investors and enthusiasts with valuable insights, helping them make informed decisions and capitalize on market opportunities. By utilizing comprehensive and accurate cryptocurrency data, individuals can navigate the dynamic and rapidly evolving cryptocurrency market with confidence.

So, whether you are a seasoned investor or a beginner, remember that cryptocurrency data is your key to unlocking the potential of this exciting asset class. Stay informed, analyze diligently, and make wise investment decisions. Best of luck on your cryptocurrency journey!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only. It should not be considered as financial or investment advice. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.

This post topic: Blockchain Insights