Unlocking The Future: Cryptocurrency Forecast For Smart Investors

Cryptocurrency Forecast: Predicting the Future of Digital Currency

Greetings, Readers! In this article, we will delve into the captivating world of cryptocurrency forecast. As digital currencies continue to gain popularity, it becomes imperative to understand their future prospects and the factors that shape their value. Join us as we explore the trends, possibilities, and implications of cryptocurrency forecast.

Introduction

The cryptocurrency market has witnessed significant growth and volatility since the emergence of Bitcoin in 2009. With the increasing number of cryptocurrencies and their evolving nature, individuals and businesses alike are eager to predict the future of these digital assets. In this introduction, we will provide a comprehensive overview of cryptocurrency forecast.

2 Picture Gallery: Unlocking The Future: Cryptocurrency Forecast For Smart Investors

What is Cryptocurrency Forecast?

🔍 Cryptocurrency forecast refers to the process of predicting the future value, trends, and performance of digital currencies. It involves analyzing various factors such as market trends, technological advancements, regulatory changes, and investor sentiment to anticipate the potential outcomes of different cryptocurrencies.

Who Predicts Cryptocurrency Forecast?

🔍 Cryptocurrency forecast is conducted by a diverse range of individuals and entities, including financial analysts, economists, data scientists, and blockchain experts. These experts employ various techniques such as technical analysis, fundamental analysis, and sentiment analysis to make informed predictions about the future performance of cryptocurrencies.

When Can Cryptocurrency Forecast Be Useful?

🔍 Cryptocurrency forecast can be incredibly useful for investors, traders, and businesses operating in the digital currency ecosystem. By gaining insights into the potential future value and trends of cryptocurrencies, individuals can make informed decisions regarding buying, selling, or holding these digital assets. Additionally, businesses can plan their strategies and investments based on the projected growth or decline of specific cryptocurrencies.

Where Can Cryptocurrency Forecast Be Applied?

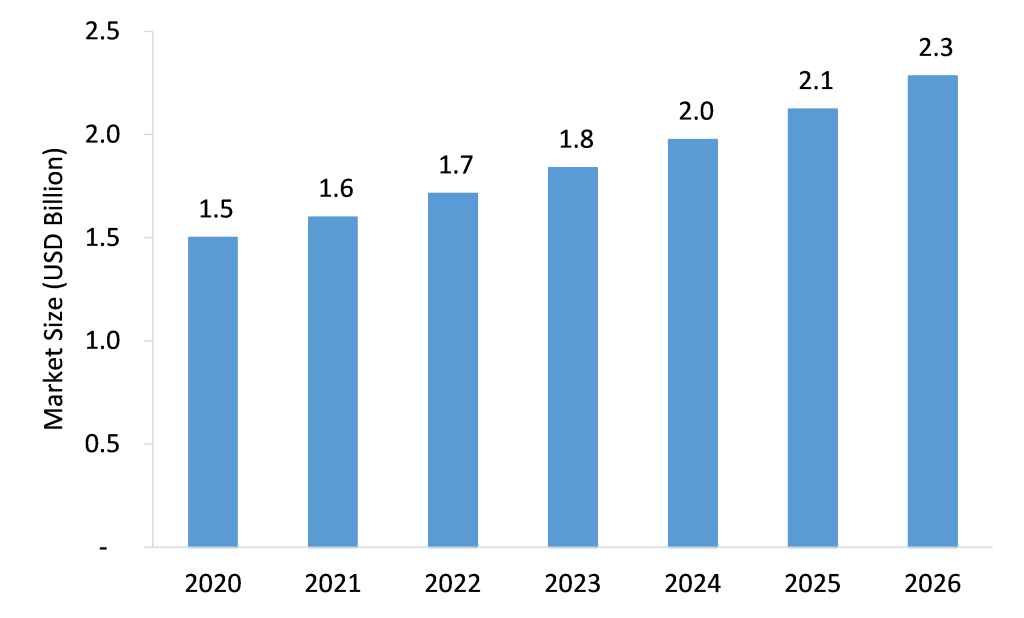

Image Source: stratviewresearch.com

🔍 Cryptocurrency forecast can be applied in various contexts, including investment portfolios, trading strategies, financial planning, and risk management. Additionally, businesses in sectors such as e-commerce, finance, and technology can use cryptocurrency forecast to evaluate the feasibility of accepting digital currencies as payment methods or incorporating blockchain technology into their operations.

Why is Cryptocurrency Forecast Important?

🔍 Cryptocurrency forecast is important for several reasons. Firstly, it helps investors and traders to make informed decisions based on projected market trends, potentially maximizing their profits and minimizing risks. Secondly, it enables businesses to assess the viability of incorporating cryptocurrencies into their operations, keeping them ahead of the curve in the rapidly evolving digital landscape.

How is Cryptocurrency Forecast Conducted?

🔍 Cryptocurrency forecast involves a multi-faceted approach that combines in-depth analysis of historical data, technical indicators, market sentiment, and fundamental factors. Experts employ various tools and methodologies such as chart patterns, moving averages, trading volumes, news analysis, and social media sentiment analysis to predict the future performance of cryptocurrencies.

Advantages and Disadvantages of Cryptocurrency Forecast

Now that we have explored the fundamentals of cryptocurrency forecast, let’s take a closer look at its advantages and disadvantages.

Advantages of Cryptocurrency Forecast

🔍 1. Potential for Profit: By analyzing cryptocurrency forecasts, investors can potentially identify undervalued assets and make profitable investments.

2. Risk Mitigation: Cryptocurrency forecast can help investors manage risks by providing insights into potential market downturns or high volatility periods.

3. Informed Decision Making: Forecasting allows individuals to make informed decisions based on data-backed predictions, increasing the chances of success in the cryptocurrency market.

Disadvantages of Cryptocurrency Forecast

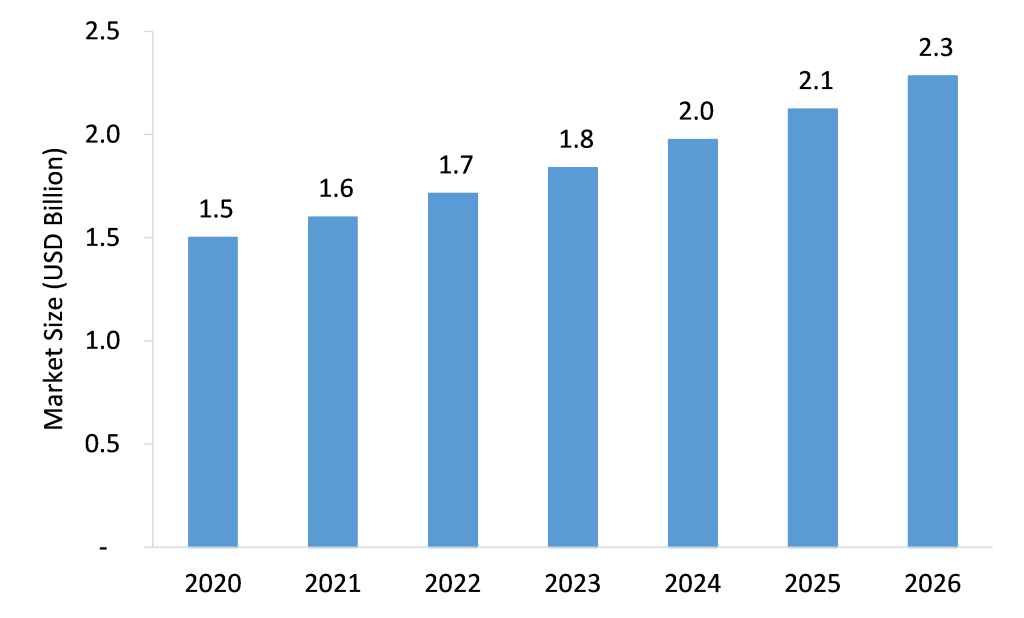

Image Source: telegra.ph

🔍 1. Uncertainty: Cryptocurrency markets are highly volatile and unpredictable, making accurate forecasting challenging.

2. Limited Data: The relative newness of cryptocurrencies limits the availability of historical data, making accurate long-term forecasts more difficult.

3. External Factors: Cryptocurrency markets are influenced by various external factors, such as regulatory changes or global economic events, which can render forecasts less reliable.

Frequently Asked Questions (FAQs)

1. Can cryptocurrency forecast guarantee accurate predictions?

🔍 No, cryptocurrency forecast cannot guarantee accurate predictions due to the inherent volatility and complexity of the market. Forecasts serve as informed estimations rather than definitive outcomes.

2. How often should I update my cryptocurrency forecast?

🔍 It is advisable to update your cryptocurrency forecast regularly, considering the ever-changing market conditions and emerging trends. A quarterly review can help you stay up-to-date with the latest developments.

3. What factors should I consider when making a cryptocurrency forecast?

🔍 When making a cryptocurrency forecast, factors such as market trends, technological advancements, regulatory changes, investor sentiment, and historical data should be taken into account. Combining multiple indicators can enhance the accuracy of your forecast.

4. How can I mitigate the risks associated with cryptocurrency forecast?

🔍 To mitigate the risks associated with cryptocurrency forecast, diversify your investments, stay updated with market news, consult expert opinions, and use risk management strategies such as stop-loss orders.

5. Is cryptocurrency forecast suitable for long-term investment planning?

🔍 Cryptocurrency forecast can provide valuable insights for long-term investment planning. However, due to the inherent volatility of the market, it is important to regularly assess and adjust your strategies based on updated forecasts.

Conclusion

In conclusion, cryptocurrency forecast plays a crucial role in understanding the future prospects of digital currencies. Whether you are an investor, trader, or business owner, keeping track of cryptocurrency forecasts can provide valuable insights and guide your decision-making process. Remember to consider the advantages, disadvantages, and expert opinions before making any investment or strategic moves in the dynamic world of cryptocurrencies.

Take action now and empower yourself with the knowledge of cryptocurrency forecast for a successful journey in the digital currency realm!

Disclaimer:

The information provided in this article is for educational and informational purposes only. It does not constitute financial advice or a recommendation to invest in cryptocurrencies. Cryptocurrency markets are highly volatile, and investments should be made after careful consideration of personal circumstances and risk tolerance. Always conduct thorough research and consult with financial professionals before making any investment decisions.

This post topic: Blockchain Insights