Unlocking The Potential: Cryptocurrency Regulation In The US – A Call To Action

Cryptocurrency Regulation in the US: Understanding the Framework and Its Impact

Introduction

Hello Readers, welcome to our comprehensive guide on cryptocurrency regulation in the United States. In recent years, cryptocurrencies have gained significant popularity and have become a hot topic of discussion not only among investors but also among regulators and policymakers. With the increasing adoption of cryptocurrencies, it is crucial to understand the regulatory landscape surrounding these digital assets. In this article, we will delve into the various aspects of cryptocurrency regulation in the US, including its purpose, impact, and key players involved.

2 Picture Gallery: Unlocking The Potential: Cryptocurrency Regulation In The US – A Call To Action

Before we dive into the details, let’s first explore what cryptocurrencies are and why they have gained so much attention in recent years.

What are Cryptocurrencies?

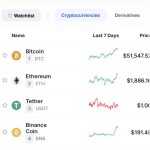

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They are decentralized and operate on blockchain technology, a distributed ledger that records all transactions across a network of computers. The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies available in the market today.

Image Source: imgix.net

Now that we have a basic understanding of cryptocurrencies, let’s explore the regulatory landscape surrounding them in the United States.

The Purpose of Cryptocurrency Regulation

The primary purpose of cryptocurrency regulation is to protect investors, maintain market integrity, and prevent illicit activities such as money laundering and fraud. Regulators aim to strike a balance between fostering innovation in the cryptocurrency space and ensuring consumer protection. By implementing regulations, governments can provide a clear framework for businesses and individuals operating in the cryptocurrency industry.

So, who are the key players in cryptocurrency regulation in the US? Let’s find out.

Regulatory Bodies and Key Players

Image Source: legamart.com

Several regulatory bodies and key players are involved in shaping the cryptocurrency regulation landscape in the US. The following are some of the most influential entities:

1. Securities and Exchange Commission (SEC) – The SEC plays a significant role in regulating cryptocurrencies that are considered securities. It enforces securities laws to protect investors and ensure fair and transparent markets.

2. Commodity Futures Trading Commission (CFTC) – The CFTC regulates cryptocurrencies that are classified as commodities. It oversees futures, options, and derivatives markets related to cryptocurrencies.

3. Financial Crimes Enforcement Network (FinCEN) – FinCEN is responsible for enforcing anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. It requires cryptocurrency businesses to register as money services businesses (MSBs) and comply with AML/CFT obligations.

4. Internal Revenue Service (IRS) – The IRS treats cryptocurrencies as property for tax purposes. It requires individuals and businesses to report their cryptocurrency transactions and pay taxes accordingly.

5. Office of the Comptroller of the Currency (OCC) – The OCC oversees national banks and federal savings associations. In 2020, it issued guidance allowing banks to provide cryptocurrency custody services to their customers.

6. State Regulators – In addition to federal regulators, individual states in the US have their own regulations and licensing requirements for cryptocurrency businesses. Some states, like New York, have implemented specific frameworks, such as the BitLicense.

Now that we are familiar with the key players, let’s explore the timeline of cryptocurrency regulation in the US.

Timeline of Cryptocurrency Regulation in the US

The regulation of cryptocurrencies in the US has evolved over time. Here is a timeline of significant events:

1. 2009 – The creation of Bitcoin by an anonymous person or group using the pseudonym Satoshi Nakamoto.

2. 2013 – The Financial Crimes Enforcement Network (FinCEN) issues guidance stating that virtual currency administrators and exchangers must register as money services businesses.

3. 2015 – The New York Department of Financial Services (NYDFS) introduces the BitLicense, a licensing framework for businesses operating with cryptocurrencies in New York.

4. 2017 – The Securities and Exchange Commission (SEC) declares that initial coin offerings (ICOs) may be subject to securities regulations.

5. 2018 – The SEC intensifies regulatory actions against fraudulent ICOs and unregistered securities offerings.

6. 2019 – The Internal Revenue Service (IRS) issues guidance on the tax treatment of cryptocurrencies.

Now that we have a timeline of cryptocurrency regulation, let’s address some common questions surrounding this topic.

Frequently Asked Questions (FAQs)

Q1: Is cryptocurrency legal in the United States?

A1: Yes, owning and using cryptocurrencies is legal in the US. However, specific regulations vary depending on the nature of the cryptocurrency and its use.

Q2: Do I have to pay taxes on my cryptocurrency holdings?

A2: Yes, the IRS treats cryptocurrencies as property, and you are required to report and pay taxes on your cryptocurrency transactions.

Q3: Can I launch an initial coin offering (ICO) in the US?

A3: ICOs may be subject to securities regulations, and you must comply with the relevant laws enforced by the SEC.

Q4: Can I buy and sell cryptocurrencies on regulated exchanges?

A4: Yes, there are several regulated cryptocurrency exchanges where you can buy and sell cryptocurrencies in compliance with applicable regulations.

Q5: Are there any advantages to cryptocurrency regulation?

A5: Cryptocurrency regulation provides protection to investors, reduces fraud, enhances market integrity, and fosters mainstream adoption of cryptocurrencies.

Now that we have addressed some common questions, let’s explore the advantages and disadvantages of cryptocurrency regulation.

Advantages and Disadvantages of Cryptocurrency Regulation

Advantages:

1. Investor Protection: Regulation helps prevent fraud, scams, and market manipulation, providing a safer environment for investors.

2. Market Integrity: By enforcing regulations, authorities maintain the integrity of the cryptocurrency market and promote fair practices.

3. Consumer Confidence: Clear regulations create trust among consumers, encouraging wider adoption of cryptocurrencies.

4. Anti-Money Laundering Measures: Regulation helps prevent illicit activities such as money laundering and terrorist financing.

5. Taxation: Regulatory frameworks ensure that individuals and businesses pay taxes on their cryptocurrency transactions, contributing to government revenue.

Disadvantages:

1. Regulatory Burden: Compliance with complex regulations can be challenging, especially for small businesses and startups.

2. Lack of Global Consensus: Cryptocurrency regulations vary across jurisdictions, creating a fragmented regulatory landscape.

3. Innovation Constraints: Overregulation may stifle innovation in the cryptocurrency industry, limiting its potential benefits.

4. Privacy Concerns: Some regulations require the collection and disclosure of personal information, raising privacy concerns among users.

5. Potential for Regulatory Arbitrage: Stringent regulations in one jurisdiction may lead to businesses relocating to more lenient jurisdictions.

Now that we have examined the advantages and disadvantages, let’s conclude our discussion on cryptocurrency regulation in the US.

Conclusion

In conclusion, cryptocurrency regulation in the United States plays a vital role in protecting investors, maintaining market integrity, and preventing illegal activities. Regulatory bodies such as the SEC, CFTC, FinCEN, IRS, OCC, and state regulators oversee different aspects of cryptocurrencies. While regulation brings advantages such as investor protection and market integrity, it also poses challenges like compliance burdens and potential innovation constraints.

As the cryptocurrency industry continues to evolve, it is crucial for regulators to strike a balance between oversight and fostering innovation. By implementing effective and forward-thinking regulation, the US can position itself as a global leader in the cryptocurrency space while promoting consumer protection and financial stability.

Final Remarks

Friends, it is important to note that cryptocurrency regulation is an ongoing process, and the regulatory landscape may evolve in the future. This article provides a broad overview of cryptocurrency regulation in the US, but it is always recommended to consult with legal and financial professionals for up-to-date and tailored advice specific to your circumstances.

Thank you for joining us on this journey to understand cryptocurrency regulation in the US. We hope you found this article informative and valuable. If you have any further questions or would like to explore this topic in more detail, please feel free to reach out to us. Happy investing!

This post topic: Blockchain Insights