The Power Of Crypto 4 Year Cycle: Unveiling The Secrets For Success

Crypto 4 Year Cycle: Understanding the Dynamics of the Cryptocurrency Market

Greetings, Readers!

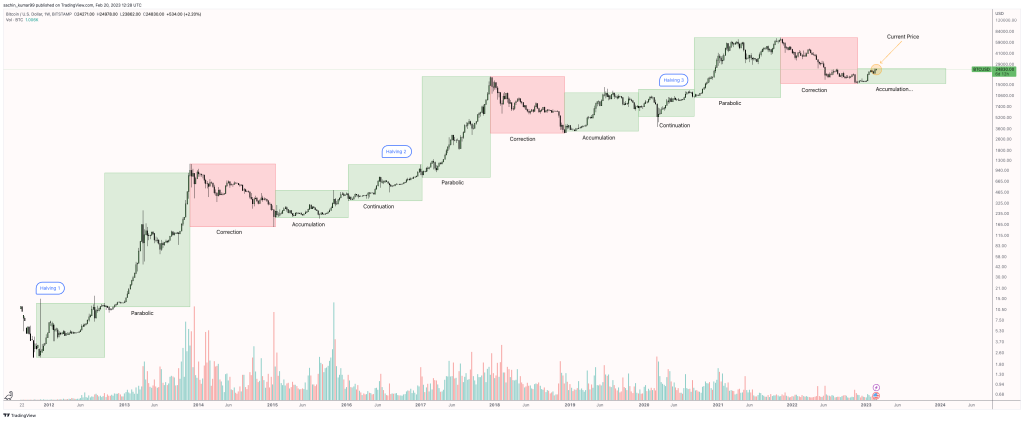

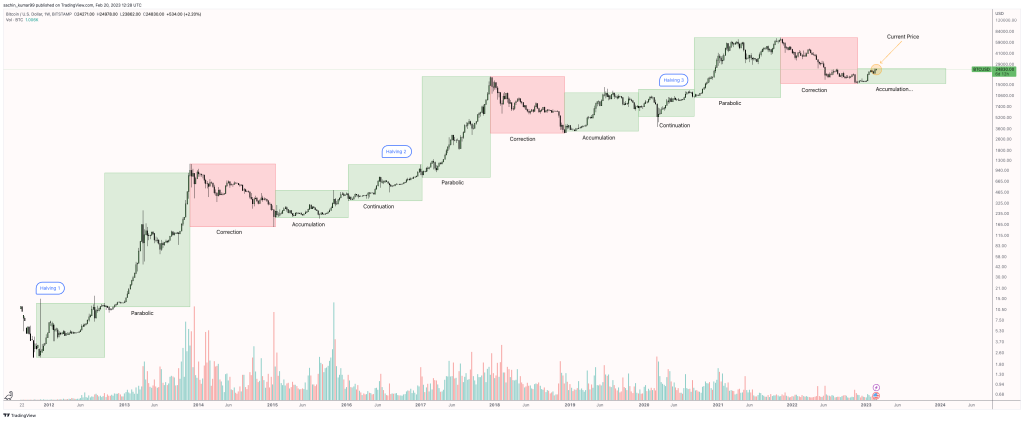

In the world of cryptocurrency, there is a phenomenon known as the crypto 4 year cycle. This cycle refers to a recurring pattern in the market that occurs approximately every four years, shaping the price movements and overall sentiment of various cryptocurrencies. In this article, we will delve into the details of the crypto 4 year cycle, exploring its what, who, when, where, why, and how, along with its advantages and disadvantages. Additionally, we will provide answers to frequently asked questions and conclude with some actionable insights.

3 Picture Gallery: The Power Of Crypto 4 Year Cycle: Unveiling The Secrets For Success

What is the Crypto 4 Year Cycle?

The crypto 4 year cycle is a market cycle that involves significant price movements and shifts in sentiment within the cryptocurrency market. It is characterized by four distinct phases: accumulation, markup, distribution, and markdown. These phases typically last for around four years before the cycle starts anew.

Accumulation Phase

In the accumulation phase, cryptocurrencies are relatively cheap and undervalued. This is the period when smart investors and institutions begin accumulating assets, anticipating future price increases. It is a period of low activity and consolidation.

Markup Phase

During the markup phase, the market experiences a rapid increase in prices. This is when the general public starts taking notice of the cryptocurrency market, leading to increased trading volumes and a surge in prices. It is a phase of optimism and excitement.

Distribution Phase

Image Source: hackernoon.com

The distribution phase occurs when the market reaches its peak. Prices start to stabilize, and early investors begin selling their holdings to realize profits. This phase is characterized by increased volatility and a sense of uncertainty among market participants.

Markdown Phase

The markdown phase is the period of decline after the distribution phase. Prices start to fall, and market sentiment turns bearish. This phase is often marked by panic selling and a lack of confidence in the market.

Who Influences the Crypto 4 Year Cycle?

The crypto 4 year cycle is influenced by various stakeholders within the cryptocurrency market. These include individual investors, institutional investors, market makers, and influential figures within the industry. Their actions and decisions impact the supply and demand dynamics of cryptocurrencies, thus shaping the cycle.

Individual Investors

Individual investors, often referred to as retail investors, play a significant role in the crypto 4 year cycle. Their buying and selling decisions, driven by market sentiment and personal beliefs, contribute to the overall price movements.

Institutional Investors

Institutional investors, such as hedge funds and asset management firms, have an increasing influence on the crypto 4 year cycle. When institutional money flows into the market, it can lead to significant price movements and increased market participation.

Market Makers

Image Source: seekingalpha.com

Market makers, who provide liquidity to the market, also impact the crypto 4 year cycle. Their buying and selling activities help stabilize the market and facilitate price discovery.

Influential Figures

Key individuals, including industry leaders, influencers, and regulatory authorities, have the power to shape the crypto 4 year cycle through their statements, actions, and policies. Their involvement can create both positive and negative sentiment within the market.

When Does the Crypto 4 Year Cycle Occur?

The crypto 4 year cycle has historically occurred in a somewhat predictable pattern. It is often associated with the Bitcoin halving event, which happens approximately every four years. The halving event reduces the rate at which new Bitcoins are created, resulting in a reduced supply of the cryptocurrency.

Bitcoin Halving Event

The Bitcoin halving event occurs when the number of new Bitcoins generated through mining is cut in half. This event creates scarcity and has a significant impact on the supply-demand dynamics of Bitcoin and other cryptocurrencies.

Timing and Duration

While the exact timing and duration of each crypto 4 year cycle may vary, historical data suggests that they typically span around four years. However, it’s important to note that past performance does not guarantee future results, and the cycle’s duration can be influenced by various factors.

Where Does the Crypto 4 Year Cycle Occur?

Image Source: ctfassets.net

The crypto 4 year cycle occurs within the global cryptocurrency market, which operates 24/7 across different geographical regions. The cycle is not limited to a specific country or location but rather encompasses the entire digital asset ecosystem.

Why Does the Crypto 4 Year Cycle Occur?

The crypto 4 year cycle is driven by a combination of factors, including market psychology, supply and demand dynamics, technological advancements, and macroeconomic trends. These factors interact with each other, creating the cyclical nature of the cryptocurrency market.

How Does the Crypto 4 Year Cycle Impact Investors?

The crypto 4 year cycle has both advantages and disadvantages for investors. Understanding these can help investors navigate the market more effectively and make informed decisions.

Advantages of the Crypto 4 Year Cycle

1. Profit Opportunities: The cycle presents opportunities for investors to profit from the price volatility and potential upward trends in the market.

2. Market Predictability: The cyclical nature of the crypto 4 year cycle allows investors to anticipate potential price movements and plan their investment strategies accordingly.

3. Long-Term Investment Potential: By recognizing the cycle, investors can take a long-term perspective and potentially benefit from the overall growth of the cryptocurrency market.

Disadvantages of the Crypto 4 Year Cycle

1. Timing Challenges: Timing the market accurately within the cycle can be challenging, as it requires careful analysis and consideration of multiple factors.

2. Market Manipulation: The cyclical nature of the market can attract manipulative activities, leading to potential risks for investors.

3. Emotional Rollercoaster: The volatility and uncertainty associated with the cycle can evoke strong emotions in investors, potentially leading to impulsive and irrational decisions.

Frequently Asked Questions

1. Is the crypto 4 year cycle applicable to all cryptocurrencies?

Yes, the crypto 4 year cycle is applicable to most cryptocurrencies, as they tend to follow the overall market trends. However, each cryptocurrency may have its unique factors that influence its price movements.

2. Can the crypto 4 year cycle be disrupted or altered?

While the crypto 4 year cycle has been observed in the past, it is important to note that future events or developments could potentially disrupt or alter the cycle. Market dynamics and external factors can impact the timing and duration of the cycle.

3. Should I base my investment decisions solely on the crypto 4 year cycle?

No, the crypto 4 year cycle should be considered as one of many factors when making investment decisions. It is crucial to conduct thorough research, analyze market trends, and consider individual risk tolerance and investment goals.

4. Can the crypto 4 year cycle guarantee profits?

No, the crypto 4 year cycle does not guarantee profits. Market conditions and individual investment strategies play significant roles in determining investment outcomes. It is essential to exercise caution and make informed decisions.

5. Are there alternative investment strategies to consider beyond the crypto 4 year cycle?

Yes, alternative investment strategies, such as dollar-cost averaging, diversification, and fundamental analysis, can complement or provide alternatives to the crypto 4 year cycle strategy. It is wise to explore and consider multiple approaches to investing.

Conclusion

In conclusion, the crypto 4 year cycle is a recurring market phenomenon that influences the dynamics of the cryptocurrency market. Understanding its various phases and factors can help investors navigate the market more effectively. While the cycle presents opportunities for profit, it also carries risks that should be carefully considered. By combining the knowledge of the crypto 4 year cycle with thorough research and informed decision-making, investors can potentially make the most of the cryptocurrency market.

Final Remarks

It is important to note that investing in cryptocurrencies involves risks, and past performance is not indicative of future results. The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Cryptocurrency markets can be highly volatile, and it is crucial to be aware of potential risks and exercise caution when participating in the market.

This post topic: Blockchain Insights