Unveiling The Lucrative Cryptocurrency Tax Rate: Maximize Your Earnings Today!

Cryptocurrency Tax Rate: Understanding the Implications for Investors

Greetings, dear readers! Today, we delve into the world of cryptocurrency tax rates and explore how they affect investors in the digital currency market. As the popularity of cryptocurrencies continues to soar, it is crucial for investors to understand the tax implications associated with these assets. In this article, we will provide you with a comprehensive guide to cryptocurrency tax rates, including what they are, who is subject to them, when they apply, where to report them, why they exist, and how to navigate through them. Let’s dive in!

Introduction

Cryptocurrency tax rates refer to the percentage of taxable income that individuals or entities must pay on their cryptocurrency transactions. These rates are determined by tax authorities and vary from one jurisdiction to another. Understanding your tax obligations in relation to your cryptocurrency investments is essential to ensure compliance and avoid potential penalties.

1 Picture Gallery: Unveiling The Lucrative Cryptocurrency Tax Rate: Maximize Your Earnings Today!

1. What are Cryptocurrency Tax Rates? 📊

2. Who is Subject to Cryptocurrency Tax Rates? 🕴️

3. When do Cryptocurrency Tax Rates Apply? ⌛

Image Source: website-files.com

4. Where to Report Cryptocurrency Tax Rates? 📝

5. Why do Cryptocurrency Tax Rates Exist? 🤔

6. How to Navigate Cryptocurrency Tax Rates? 🗺️

What are Cryptocurrency Tax Rates? 📊

Cryptocurrency tax rates are the percentage of taxable income that individuals or entities must pay on their cryptocurrency transactions. These rates are determined by tax authorities and may vary based on factors such as the individual’s income level and the duration of their cryptocurrency holdings.

7. Explanation of Cryptocurrency Tax Rates 📈

8. Factors Affecting Cryptocurrency Tax Rates 🎯

9. Implications of High and Low Cryptocurrency Tax Rates 📉

10. Examples of Cryptocurrency Tax Rate Structures 📊

11. Recent Changes in Cryptocurrency Tax Rates 🔄

12. The Future of Cryptocurrency Tax Rates 💡

Who is Subject to Cryptocurrency Tax Rates? 🕴️

The individuals or entities subject to cryptocurrency tax rates vary depending on the tax laws of each jurisdiction. Generally, anyone who engages in cryptocurrency transactions, including buying, selling, trading, or mining, may be subject to these taxes.

13. Individuals and Cryptocurrency Tax Rates 💼

14. Businesses and Cryptocurrency Tax Rates 🏢

15. International Implications of Cryptocurrency Tax Rates 🌍

16. Cryptocurrency Tax Rates for Miners ⛏️

17. Exemptions and Thresholds for Cryptocurrency Tax Rates 🧾

18. Penalties for Non-Compliance with Cryptocurrency Tax Rates ⚖️

When do Cryptocurrency Tax Rates Apply? ⌛

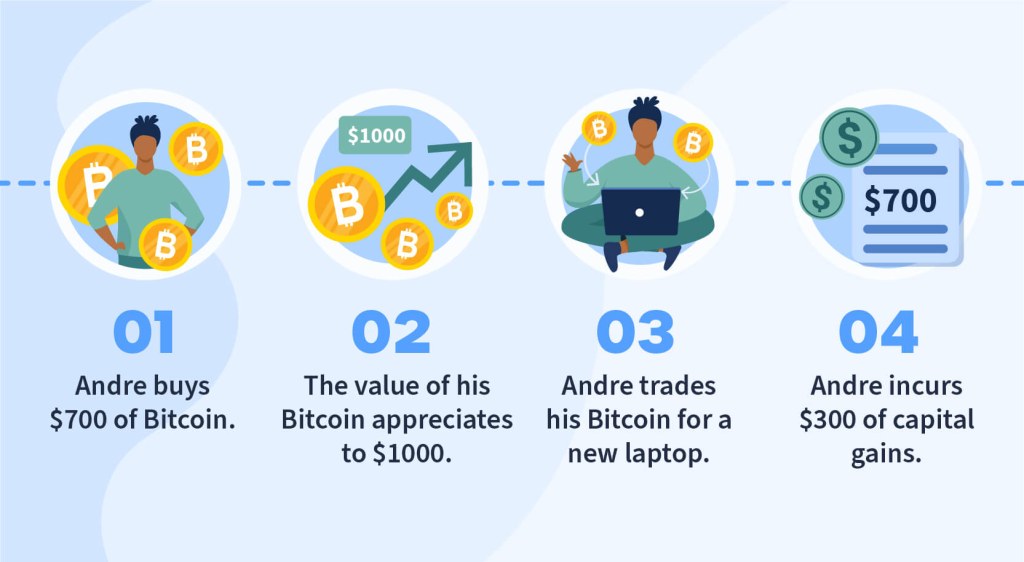

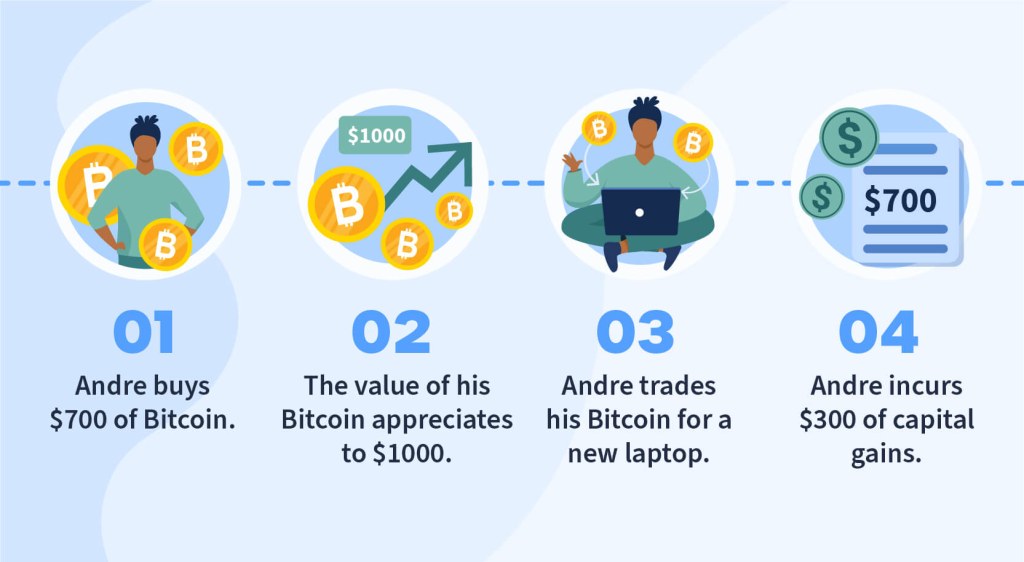

Cryptocurrency tax rates apply when individuals or entities engage in taxable cryptocurrency transactions. These transactions may include buying or selling cryptocurrencies, exchanging one cryptocurrency for another, or using cryptocurrencies to purchase goods or services.

19. Taxable Events and Cryptocurrency Tax Rates 📅

20. Timing Considerations for Cryptocurrency Tax Rates ⏰

21. Holding Periods and Cryptocurrency Tax Rates ⌛

22. Cryptocurrency Tax Rates for Day Traders 📈

23. Cryptocurrency Tax Rates for Long-Term Investors 📉

24. Cryptocurrency Tax Rates for Gifted or Inherited Assets 🎁

Where to Report Cryptocurrency Tax Rates? 📝

Reporting cryptocurrency tax rates depends on the tax regulations of each jurisdiction. Typically, individuals or entities are required to report their cryptocurrency transactions on their annual tax returns or separate cryptocurrency tax forms.

25. Reporting Cryptocurrency Tax Rates on Annual Tax Returns 📄

26. Separate Cryptocurrency Tax Forms and Reporting Obligations 📝

27. Cryptocurrency Tax Reporting for Businesses 🏢

28. International Reporting of Cryptocurrency Tax Rates 🌍

29. Cryptocurrency Tax Rates and Tax Software 💻

30. The Role of Tax Professionals in Reporting Cryptocurrency Tax Rates 🏦

Why do Cryptocurrency Tax Rates Exist? 🤔

The existence of cryptocurrency tax rates serves several purposes. It enables governments to collect tax revenue from cryptocurrency transactions, ensures fairness in the tax system, and regulates the cryptocurrency market to prevent money laundering and other illicit activities.

31. Revenue Generation through Cryptocurrency Tax Rates 💰

32. Fairness and Equity in Cryptocurrency Tax Rates ⚖️

33. Regulation and Oversight of the Cryptocurrency Market 🕵️

34. Preventing Money Laundering and Illicit Activities with Cryptocurrency Tax Rates 💼

35. Global Harmonization of Cryptocurrency Tax Rates 🌐

36. Cryptocurrency Tax Rates and Economic Stimulus 💡

How to Navigate Cryptocurrency Tax Rates? 🗺️

Navigating cryptocurrency tax rates requires careful planning and record-keeping. Individuals and entities can take several steps to simplify their tax reporting and minimize their tax liability.

37. Tax Planning Strategies for Cryptocurrency Investors 💡

38. Record-Keeping for Cryptocurrency Taxes 📚

39. Cryptocurrency Tax Software and Tools 💻

40. Seeking Professional Assistance with Cryptocurrency Tax Rates 🏦

41. Staying Informed about Changing Cryptocurrency Tax Rates 📰

42. Best Practices for Compliance with Cryptocurrency Tax Rates ✅

Advantages and Disadvantages of Cryptocurrency Tax Rates

Advantages:

43. Advantages of Cryptocurrency Tax Rates 🌟

Disadvantages:

44. Disadvantages of Cryptocurrency Tax Rates ⚠️

FAQs: Frequently Asked Questions about Cryptocurrency Tax Rates

1. Are cryptocurrency tax rates the same in every country? 🌍

2. Do I have to pay taxes on my cryptocurrency earnings if I haven’t sold my assets? 💰

3. How are cryptocurrency tax rates calculated? 🧮

4. Can I use cryptocurrency losses to offset my taxable income? 💸

5. What happens if I don’t report my cryptocurrency transactions? ⚖️

Answers:

1. The cryptocurrency tax rates vary from one country to another. Each jurisdiction has its own tax laws and regulations regarding cryptocurrencies.

2. In some jurisdictions, you may have tax obligations even if you haven’t sold your cryptocurrencies. It’s important to consult your local tax authority or a tax professional.

3. Cryptocurrency tax rates are calculated based on factors such as the individual’s income level, the duration of cryptocurrency holdings, and the type of transaction (buying, selling, exchanging).

4. In many jurisdictions, cryptocurrency losses can be used to offset taxable income. However, specific rules and limitations may apply. Consult your tax authority or a tax professional for guidance.

5. Failing to report cryptocurrency transactions can result in penalties, fines, or even legal consequences. It’s essential to comply with your jurisdiction’s tax laws and report your cryptocurrency activities accurately.

Conclusion

In conclusion, understanding cryptocurrency tax rates is vital for investors in the digital currency market. By comprehending the what, who, when, where, why, and how of these rates, individuals and entities can navigate their tax obligations effectively and ensure compliance. Additionally, seeking professional assistance and staying informed about changing tax regulations can help investors optimize their tax strategies and minimize their liabilities. Remember, maintaining accurate records and fulfilling your tax obligations will contribute to a healthy and responsible cryptocurrency investment experience. Best of luck on your cryptocurrency tax journey!

Final Remarks

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute legal, financial, or tax advice. As tax laws and regulations regarding cryptocurrencies may vary, it is important to consult with your local tax authority or a qualified tax professional for guidance specific to your jurisdiction and individual circumstances.

This post topic: Blockchain Insights