Unlock The Potential Of Crypto Options Trading: Amplify Your Earnings With Cryptocurrency Options Trading

Cryptocurrency Options Trading: A Comprehensive Guide to Investing in Digital Assets

Introduction

Dear Readers,

3 Picture Gallery: Unlock The Potential Of Crypto Options Trading: Amplify Your Earnings With Cryptocurrency Options Trading

Welcome to our comprehensive guide on cryptocurrency options trading. In this article, we will delve into the world of digital assets, exploring the ins and outs of options trading. Whether you are a seasoned investor or a newcomer to the cryptocurrency market, this guide aims to provide you with valuable insights and knowledge to navigate this exciting and potentially lucrative investment option. So, let’s dive in and explore the world of cryptocurrency options trading!

Table of Contents:

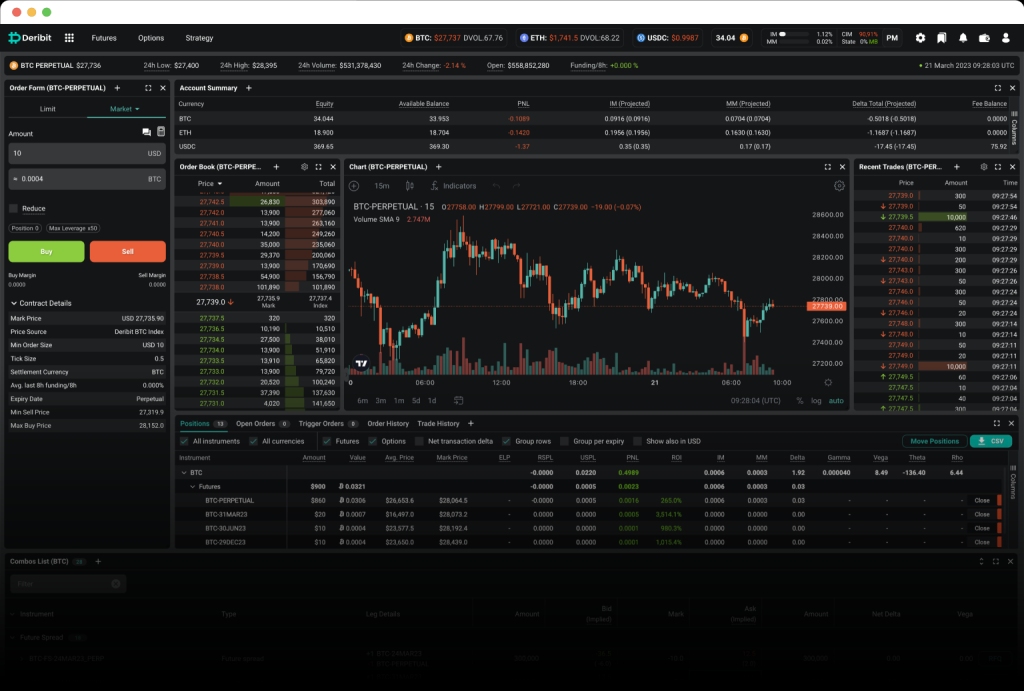

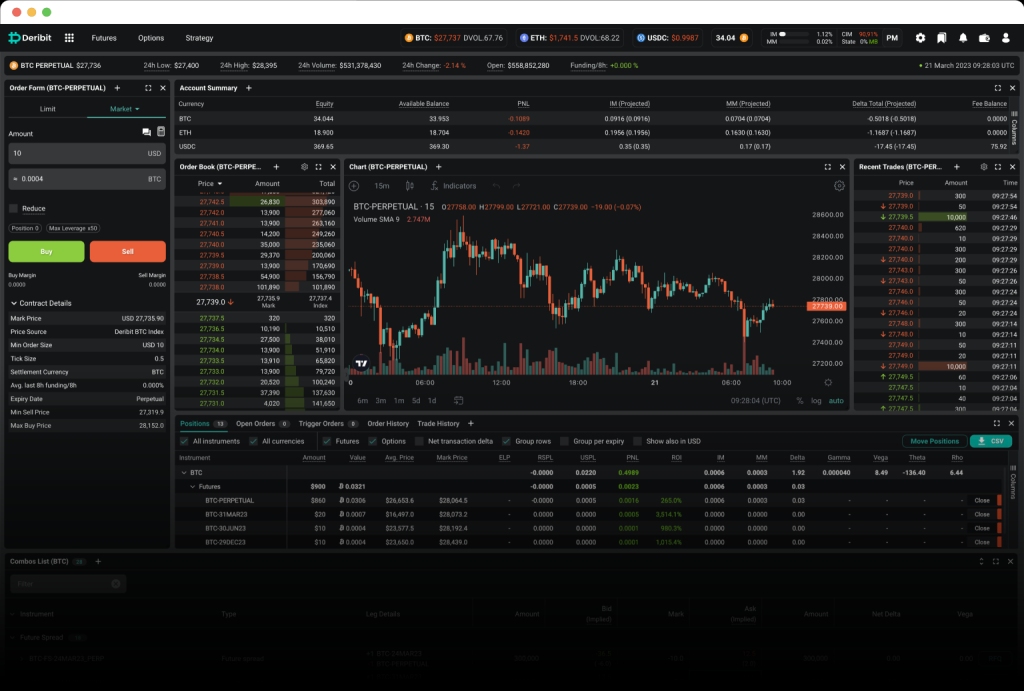

Image Source: deribit.com

1. What is cryptocurrency options trading?

2. Who can participate in cryptocurrency options trading?

3. When is the ideal time to engage in cryptocurrency options trading?

Image Source: investopedia.com

4. Where can you trade cryptocurrency options?

5. Why should you consider cryptocurrency options trading?

Image Source: coincentral.com

6. How does cryptocurrency options trading work?

What is cryptocurrency options trading?

🔍 Cryptocurrency options trading refers to the practice of buying and selling options contracts based on digital assets such as Bitcoin, Ethereum, or Litecoin. Options contracts provide traders with the right, but not the obligation, to buy or sell a specific amount of a cryptocurrency at a predetermined price within a certain timeframe.

📝 This type of trading allows investors to profit from the price movements of cryptocurrencies without having to own the underlying assets. It offers flexibility and potential financial gains while mitigating risks associated with direct cryptocurrency investments.

Who can participate in cryptocurrency options trading?

🔍 Cryptocurrency options trading is open to both individual and institutional investors. Anyone with access to a cryptocurrency exchange platform that offers options trading can participate in this market. Whether you are a seasoned trader or a novice investor, cryptocurrency options trading provides an avenue for diversifying your investment portfolio and potentially maximizing your returns.

📝 However, it is important to note that options trading involves a certain level of risk, and individuals should thoroughly educate themselves on the intricacies of this investment strategy before diving in.

When is the ideal time to engage in cryptocurrency options trading?

🔍 The ideal timing for engaging in cryptocurrency options trading varies depending on market conditions and individual investment goals. Cryptocurrency markets are highly volatile, influenced by numerous factors such as regulatory developments, technological advancements, and market sentiment.

📝 It is crucial to conduct thorough research and analysis to identify potential opportunities and determine an optimal entry point. Traders often rely on technical indicators, fundamental analysis, and market trends to make informed decisions about when to enter or exit cryptocurrency options trades.

Where can you trade cryptocurrency options?

🔍 Cryptocurrency options trading platforms are available on reputable cryptocurrency exchanges. These exchanges offer a range of options contracts for various digital assets, allowing traders to choose the contracts that align with their investment strategies and risk appetite.

📝 Some popular cryptocurrency exchanges that provide options trading services include Binance, Coinbase Pro, Kraken, and Deribit. It is essential to choose a reliable and secure platform with a user-friendly interface and robust trading tools to ensure a smooth trading experience.

Why should you consider cryptocurrency options trading?

🔍 Cryptocurrency options trading offers several advantages to investors. Here are some key reasons why you might consider this investment strategy:

1. 📈 Potential for Profit: Options trading allows for leveraging market movements, providing opportunities for significant financial gains.

2. ⚖️ Risk Management: Options contracts provide a predetermined level of risk, allowing traders to limit potential losses.

3. 💰 Diversification: Cryptocurrency options trading allows investors to diversify their portfolio by accessing various digital assets without direct ownership.

4. 🌍 Global Market Access: Cryptocurrency options trading operates 24/7, enabling investors to engage in trades at any time, regardless of their geographical location.

5. 💡 Flexibility: Options contracts offer flexibility in terms of trading strategies, allowing traders to implement different approaches based on market conditions.

How does cryptocurrency options trading work?

🔍 Cryptocurrency options trading involves two primary types of options: call options and put options. Call options give traders the right to buy a specific amount of a cryptocurrency asset at a predetermined price (the strike price) within a specific timeframe. Put options, on the other hand, provide traders the right to sell a specific amount of a cryptocurrency asset at the strike price within a specific timeframe.

📝 Traders can choose to be a buyer (holder) or a seller (writer) of options contracts. Buyers pay a premium to acquire the rights associated with the options contract, while sellers receive the premium and bear the obligation to fulfill the terms of the contract if exercised.

Advantages and Disadvantages of Cryptocurrency Options Trading

Advantages:

1. Potential for significant financial gains.

2. Risk management through predetermined levels of risk.

3. Portfolio diversification by accessing various digital assets.

4. Global market accessibility, operating 24/7.

5. Flexibility in trading strategies.

Disadvantages:

1. Options trading involves complex concepts and requires thorough understanding.

2. High volatility in cryptocurrency markets may lead to substantial losses.

3. Options contracts have an expiration date, limiting the timeframe for potential profits.

4. Traders may face liquidity challenges, impacting their ability to execute trades.

5. Regulatory uncertainties and market manipulation risks can affect cryptocurrency options trading.

FAQs (Frequently Asked Questions)

1. What is the minimum capital required to start cryptocurrency options trading?

📝 The minimum capital required to start cryptocurrency options trading varies depending on the exchange and specific contracts being traded. It is advisable to start with an amount you are comfortable risking and gradually increase your investment as you gain experience and confidence in your trading abilities.

2. Are there any regulations governing cryptocurrency options trading?

📝 Regulatory frameworks for cryptocurrency options trading vary across jurisdictions. It is essential to research and comply with the relevant laws and regulations in your country to ensure legal compliance and protect your investments.

3. Can I trade cryptocurrency options on my mobile device?

📝 Yes, many cryptocurrency exchanges offer mobile applications that allow you to trade options conveniently from your smartphone. These apps provide real-time market data, trading charts, and order placement functionalities.

4. What risks should I consider before engaging in cryptocurrency options trading?

📝 Some key risks to consider before engaging in cryptocurrency options trading include market volatility, liquidity risks, counterparty risks, regulatory risks, and technology-related risks such as hacking and system failures. It is crucial to conduct thorough risk assessments and employ risk management strategies to mitigate these potential risks.

5. How can I learn more about cryptocurrency options trading?

📝 There are various resources available to learn more about cryptocurrency options trading, including online courses, trading tutorials, books, and forums. It is recommended to start with educational materials provided by reputable sources and gradually gain practical experience through paper trading or small real-money trades.

Conclusion

In conclusion, cryptocurrency options trading offers investors a unique opportunity to engage in the dynamic world of digital assets. It provides potential financial gains, risk management tools, and portfolio diversification options. However, it is crucial to approach this investment strategy with caution and thorough understanding, as it involves complex concepts and inherent risks.

We hope this comprehensive guide has provided you with valuable insights and knowledge to navigate cryptocurrency options trading successfully. Remember to conduct thorough research, stay updated on market trends, and employ risk management strategies to enhance your chances of success.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice. Cryptocurrency options trading involves a level of risk, and individuals should thoroughly educate themselves and seek professional advice before making any investment decisions.

This post topic: Blockchain Insights