Unlock The Potential: Embrace The Thriving World Of Cryptocurrency Hedge Fund

Cryptocurrency Hedge Fund: The Future of Investing

Greetings, Readers! In today’s article, we will explore the fascinating world of cryptocurrency hedge funds and their potential for revolutionizing the investment landscape. As cryptocurrencies continue to gain traction, hedge funds dedicated to this digital asset class have emerged as a popular choice for investors seeking high returns with managed risk. Join us as we delve into the intricacies of cryptocurrency hedge funds and discover why they are becoming the go-to investment vehicle for many.

Introduction

1. Understanding Cryptocurrency Hedge Funds

2 Picture Gallery: Unlock The Potential: Embrace The Thriving World Of Cryptocurrency Hedge Fund

Cryptocurrency hedge funds are investment funds that pool capital from multiple investors to invest in various cryptocurrencies and related assets. These funds are managed by experienced professionals who utilize their expertise to generate profits by taking advantage of market trends, arbitrage opportunities, and advanced trading strategies.

2. The Growth of the Cryptocurrency Market

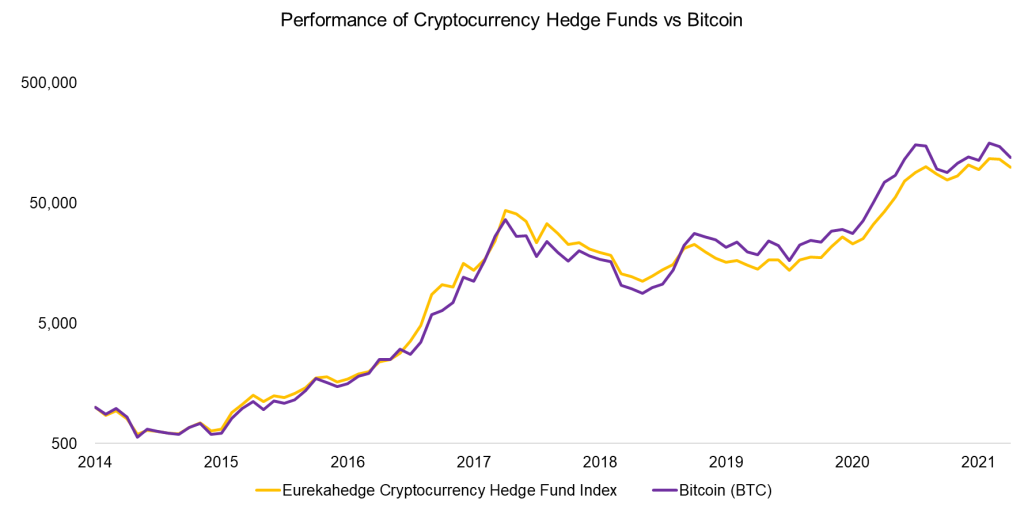

Image Source: ctfassets.net

The cryptocurrency market has witnessed tremendous growth over the past decade. With the rise of Bitcoin, Ethereum, and other digital currencies, investors have recognized the potential for significant returns in this new asset class. As a result, the demand for cryptocurrency hedge funds has soared, attracting both institutional and individual investors.

3. Diversification and Risk Management

One of the primary advantages of cryptocurrency hedge funds is the ability to diversify investments across various cryptocurrencies. By spreading investments across different assets, hedge funds aim to mitigate risk and reduce exposure to any single cryptocurrency. This diversification strategy helps protect investors’ capital while maximizing potential returns.

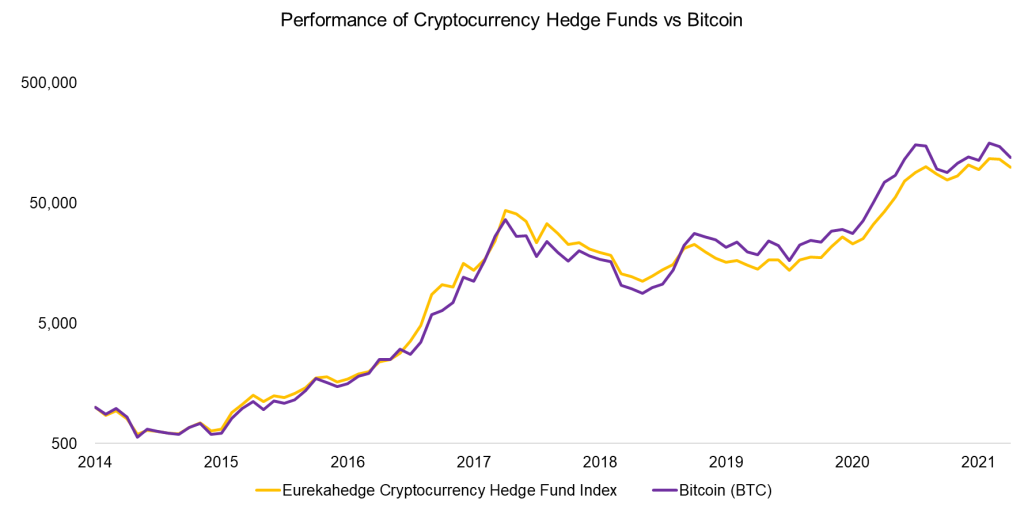

Image Source: prod-upp-image-read.ft.com

4. Enhanced Returns through Active Management

Cryptocurrency hedge funds employ active investment strategies, which involve frequent trading and portfolio adjustments to capitalize on market fluctuations. By closely monitoring the market and utilizing advanced trading techniques, these funds aim to outperform traditional long-term investment strategies, potentially delivering higher returns.

5. Access to Expertise and Research

Cryptocurrency hedge funds provide investors with access to a team of experienced professionals who specialize in the cryptocurrency market. These experts conduct in-depth research, analyze market trends, and identify investment opportunities that may not be readily available to individual investors. By leveraging their expertise, hedge funds offer a unique advantage in navigating the complex cryptocurrency landscape.

6. Regulatory Compliance and Investor Protection

Unlike individual cryptocurrency investments, hedge funds often operate within regulatory frameworks, providing investors with a greater degree of security and transparency. By adhering to regulatory guidelines, these funds aim to protect investor interests and ensure compliance with applicable laws, adding an extra layer of safety to the investment process.

7. Potential Challenges and Risks

While cryptocurrency hedge funds offer promising investment opportunities, it’s important to acknowledge the potential challenges and risks associated with this asset class. Volatility remains a significant concern in the cryptocurrency market, and hedge funds are not immune to market downturns. Additionally, the nascent nature of the cryptocurrency industry presents uncertainties that could impact fund performance.

What is a Cryptocurrency Hedge Fund and How Does it Work?

1. Definition and Structure

A cryptocurrency hedge fund is an investment vehicle that combines elements of a traditional hedge fund and the unique characteristics of the cryptocurrency market. It pools capital from multiple investors and employs various strategies to generate profits from cryptocurrency investments.

2. Investment Strategies

Cryptocurrency hedge funds utilize a range of investment strategies, including long-term holdings, day trading, arbitrage, and initial coin offerings (ICOs). The choice of strategy depends on the fund’s investment philosophy, risk appetite, and market conditions.

3. Fund Management and Team

Hedge funds are managed by experienced professionals who possess a deep understanding of the cryptocurrency market. These individuals have backgrounds in finance, technology, and blockchain, enabling them to make informed investment decisions and navigate the complexities of the digital asset landscape.

4. Risk Management and Diversification

Risk management is a critical aspect of cryptocurrency hedge fund operations. Funds employ various risk management techniques, including diversification across multiple cryptocurrencies, thorough due diligence on potential investments, and implementation of stop-loss orders to limit losses.

5. Performance and Returns

Cryptocurrency hedge funds aim to provide investors with consistent and attractive returns. The performance of these funds is measured against benchmarks such as Bitcoin or Ethereum, as well as traditional hedge fund indices. Returns can vary significantly depending on market conditions and the fund’s investment strategies.

6. Fees and Investor Requirements

Cryptocurrency hedge funds typically charge investors a management fee and a performance fee. The management fee covers operational expenses, while the performance fee is a percentage of profits generated by the fund. Minimum investment requirements can vary, with some funds imposing high entry thresholds.

7. Regulatory Landscape

The regulatory landscape for cryptocurrency hedge funds is rapidly evolving. Governments and financial authorities are increasingly scrutinizing these funds to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Investors should carefully consider the regulatory environment when evaluating potential funds.

Advantages and Disadvantages of Cryptocurrency Hedge Funds

1. Advantages of Cryptocurrency Hedge Funds

🔹 Potential for High Returns: Cryptocurrency hedge funds offer the potential for significant returns due to the volatility and growth potential of the cryptocurrency market.

🔹 Diversification: By investing in a variety of cryptocurrencies, hedge funds can spread risk and protect investors’ capital from fluctuations in any single asset.

🔹 Access to Expertise: Hedge funds provide access to experienced professionals who analyze market trends and identify investment opportunities that may not be readily available to individual investors.

🔹 Risk Management: Funds employ risk management techniques to mitigate potential losses and protect investor capital.

🔹 Regulatory Compliance: Many cryptocurrency hedge funds operate within regulatory frameworks, offering investors a higher degree of security and transparency.

2. Disadvantages of Cryptocurrency Hedge Funds

🔹 Volatility: The cryptocurrency market is known for its volatility, which can lead to significant fluctuations in fund performance.

🔹 High Fees: Cryptocurrency hedge funds often charge management fees and performance fees, which can erode investor returns.

🔹 Market Uncertainty: The nascent nature of the cryptocurrency industry presents uncertainties that can impact fund performance and investor confidence.

🔹 Limited Regulation: While some cryptocurrency hedge funds operate within regulatory frameworks, the industry as a whole lacks comprehensive regulation, posing potential risks for investors.

🔹 Counterparty Risk: Investing in cryptocurrency hedge funds exposes investors to counterparty risk, as the funds rely on third-party service providers for custody, trading, and other operations.

Frequently Asked Questions (FAQ)

1. Are cryptocurrency hedge funds suitable for all investors?

Yes, cryptocurrency hedge funds can be suitable for both institutional and individual investors who are willing to take on the risks associated with this asset class.

2. How do I choose the right cryptocurrency hedge fund?

When selecting a cryptocurrency hedge fund, it is crucial to consider factors such as fund performance, investment strategies, team expertise, regulatory compliance, and fees.

3. What is the minimum investment requirement for cryptocurrency hedge funds?

The minimum investment requirement varies among cryptocurrency hedge funds, with some funds imposing high entry thresholds. It is essential to check the specific requirements of each fund.

4. What are the tax implications of investing in cryptocurrency hedge funds?

Tax implications can vary depending on the jurisdiction and the investor’s individual circumstances. It is advisable to consult with a tax professional to understand the tax implications of investing in cryptocurrency hedge funds.

5. Can I redeem my investment in a cryptocurrency hedge fund at any time?

Redemption terms vary among cryptocurrency hedge funds. Some funds may have lock-up periods, during which investors cannot redeem their investments. It is essential to review the fund’s terms and conditions before investing.

Conclusion

In conclusion, cryptocurrency hedge funds offer investors a unique opportunity to participate in the rapidly growing world of cryptocurrencies with the guidance of experienced professionals. While these funds come with their own set of risks, their potential for high returns, diversification benefits, and access to expertise make them an attractive investment option for those willing to navigate the volatile cryptocurrency market.

We encourage you to conduct thorough research and consider your investment goals and risk tolerance before investing in a cryptocurrency hedge fund. By staying informed and making well-informed decisions, you can potentially unlock the rewards offered by this exciting investment avenue.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice. Cryptocurrency investments carry inherent risks, including the potential loss of capital. Individuals considering investing in cryptocurrency hedge funds should conduct their own due diligence and seek professional advice if needed.

This post topic: Blockchain Insights