Unlock The Power Of Cryptocurrency Contract Trading: Click To Transform Your Crypto Portfolio!

Cryptocurrency Contract Trading: A Comprehensive Guide

Introduction

Welcome, Readers!

3 Picture Gallery: Unlock The Power Of Cryptocurrency Contract Trading: Click To Transform Your Crypto Portfolio!

In today’s digital age, cryptocurrency has revolutionized the financial landscape. One of the most intriguing aspects of this innovation is cryptocurrency contract trading. This cutting-edge concept has gained significant popularity among investors and traders. In this article, we will delve into the world of cryptocurrency contract trading, providing you with a comprehensive guide to understand and navigate this exciting financial realm.

Image Source: phemex.com

So, let’s embark on this informative journey and explore the ins and outs of cryptocurrency contract trading!

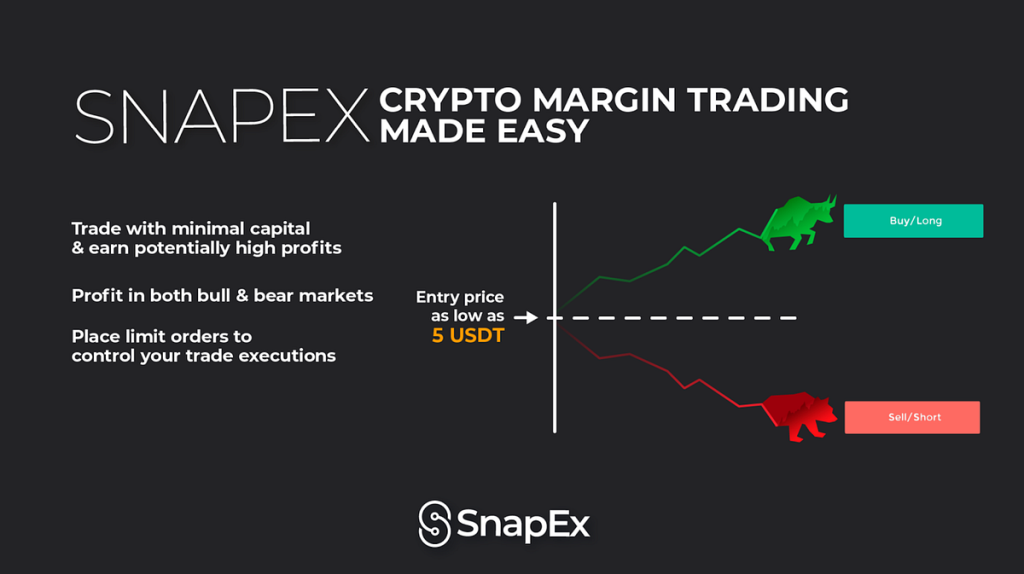

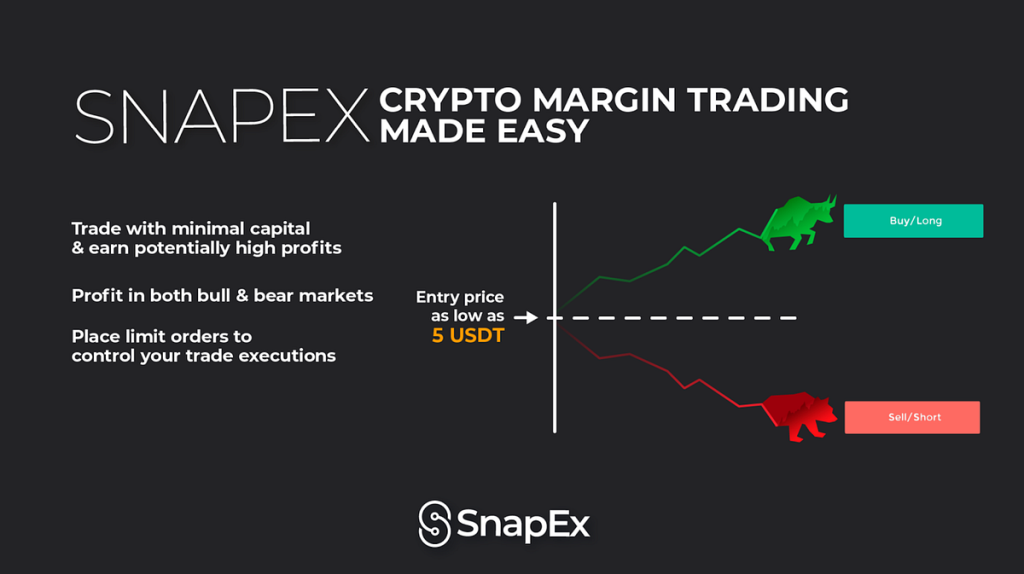

What is Cryptocurrency Contract Trading? 🤔

Cryptocurrency contract trading refers to the practice of trading derivatives based on the value of cryptocurrencies. These derivatives, known as contracts for difference (CFDs), allow traders to speculate on the price movement of cryptocurrencies without actually owning them. It enables investors to profit from both rising and falling cryptocurrency prices.

By entering into a contract with a brokerage platform, traders can take advantage of leverage, which amplifies their trading positions. This means that even small price movements can result in significant gains or losses, depending on the trader’s position.

Image Source: bnbstatic.com

Cryptocurrency contract trading offers a unique and flexible way to participate in the cryptocurrency market, providing opportunities for both short-term and long-term trading strategies.

Who Can Engage in Cryptocurrency Contract Trading? 🙋♂️🙋♀️

Cryptocurrency contract trading is open to a wide range of individuals, including both experienced traders and newcomers to the world of cryptocurrencies. With the accessibility of online trading platforms, anyone with an internet connection can engage in this form of trading.

Image Source: medium.com

However, it is essential to note that cryptocurrency contract trading involves a certain level of risk. Therefore, it is advisable for traders to have a solid understanding of both cryptocurrency markets and trading strategies before venturing into this domain. Proper risk management techniques and continuous learning are crucial to ensure a successful trading journey.

When Can You Trade Cryptocurrency Contracts? ⏰

Cryptocurrency contract trading is available 24/7, allowing traders to participate in the market at any time. Unlike traditional stock exchanges that have specific operating hours, cryptocurrency markets are decentralized and operate around the clock.

This flexibility empowers traders to strategize and execute their trades according to their preferred schedule. Whether you are a night owl or an early bird, cryptocurrency contract trading caters to your trading needs.

Where Can You Trade Cryptocurrency Contracts? 🌍

Various online brokerage platforms offer cryptocurrency contract trading services. These platforms act as intermediaries, connecting traders to the cryptocurrency markets. It is important to choose a reputable and regulated platform to ensure the security of your funds and a fair trading environment.

Before committing to a specific platform, take the time to research and compare the features, fees, and user reviews of different platforms. This will enable you to make an informed decision and select a platform that aligns with your trading goals and preferences.

Why Choose Cryptocurrency Contract Trading? 🤷♂️🤷♀️

There are several reasons why cryptocurrency contract trading has gained popularity among traders:

Profit Potential: Cryptocurrency contract trading offers significant profit potential due to the leverage provided by trading platforms. Traders can amplify their gains, making it possible to generate substantial returns even with small investments.

Market Volatility: Cryptocurrency markets are known for their volatility, which creates ample trading opportunities. Traders can profit from both upward and downward price movements, allowing for diverse trading strategies.

Diversification: Cryptocurrency contract trading provides traders with the ability to diversify their investment portfolios. By trading various cryptocurrencies, traders can spread their risk and potentially benefit from different market trends.

Liquidity: The cryptocurrency market is highly liquid, meaning traders can enter and exit positions quickly. This ensures that traders can take advantage of market opportunities and manage their risk effectively.

Accessibility: Cryptocurrency contract trading is accessible to individuals worldwide. With the rise of online trading platforms, traders from different countries can participate in the market, democratizing access to financial opportunities.

Disadvantages and Risks of Cryptocurrency Contract Trading ❌⚠️

While cryptocurrency contract trading offers enticing benefits, it is essential to consider the potential disadvantages and risks:

Market Volatility: While market volatility can be advantageous, it also poses risks. Sharp price fluctuations can lead to significant losses if traders fail to implement proper risk management strategies.

Leverage Risks: While leverage can amplify profits, it can also amplify losses. Traders should be cautious when using leverage and ensure they fully understand the associated risks.

Regulatory Uncertainty: The cryptocurrency market is still evolving, and regulatory frameworks are continuously being developed. Traders should stay informed about regulatory changes that may impact their trading activities.

Technical Complexity: Cryptocurrency contract trading involves understanding technical indicators, chart analysis, and trading platforms. Traders need to invest time and effort into learning these aspects to make informed trading decisions.

Counterparty Risk: When engaging in cryptocurrency contract trading, traders rely on the platforms they trade with. It is crucial to choose reputable platforms to mitigate the risk of fraud or other issues.

Frequently Asked Questions (FAQs) ❓

1. Can I trade cryptocurrency contracts with a small investment?

Yes, cryptocurrency contract trading allows traders to enter the market with small investments due to the leverage provided by trading platforms.

2. Do I need to own cryptocurrencies to engage in cryptocurrency contract trading?

No, cryptocurrency contract trading allows traders to speculate on the price movement of cryptocurrencies without owning them.

3. How can I manage the risks involved in cryptocurrency contract trading?

Proper risk management techniques, such as setting stop-loss orders and diversifying your trading portfolio, can help manage the risks associated with cryptocurrency contract trading.

4. Are cryptocurrency contract trading platforms regulated?

Not all platforms are regulated, but it is advisable to choose regulated platforms to ensure the security of your funds and a fair trading environment.

5. Can I engage in cryptocurrency contract trading from any country?

Yes, cryptocurrency contract trading is accessible to individuals from various countries, thanks to online trading platforms.

Conclusion: Start Your Cryptocurrency Contract Trading Journey Today!

Now that you have gained a comprehensive understanding of cryptocurrency contract trading, it’s time to take action. Begin by educating yourself further, honing your trading skills, and carefully selecting a reputable trading platform that suits your needs.

Remember, cryptocurrency contract trading offers both opportunities and risks. Stay informed, implement effective risk management strategies, and continuously adapt your trading approach as the market evolves.

Final Remarks

Disclaimer: The information provided in this article is for educational and informational purposes only. It should not be considered as financial or investment advice. Cryptocurrency contract trading involves risks, and individuals should conduct thorough research and seek professional guidance before engaging in any trading activities.

This post topic: Blockchain Insights