Unlocking The Potential Of Cryptocurrency In The United States: A Game-Changing CTA!

Cryptocurrency in the United States: Exploring the Digital Currency Revolution

Greetings, Readers! Today, we delve into the fascinating world of cryptocurrency and its impact in the United States. As digital currencies gain popularity, understanding their role and importance in the financial landscape has become crucial. In this article, we will provide you with a comprehensive overview of cryptocurrency in the United States, shedding light on its inception, significance, advantages, disadvantages, and more. So, fasten your seatbelts and join us on this informative journey!

Introduction: Understanding Cryptocurrency in the United States

The United States, being a global economic powerhouse, has been at the forefront of the cryptocurrency revolution. Cryptocurrency refers to a digital form of currency that utilizes encryption techniques to secure transactions and control the creation of new units. It operates independently of central banks and traditional financial institutions, relying on a decentralized network called blockchain. This technology ensures transparency, security, and immutability of transactions.

1 Picture Gallery: Unlocking The Potential Of Cryptocurrency In The United States: A Game-Changing CTA!

The cryptocurrency market in the United States has witnessed significant growth, with various digital currencies gaining traction. Bitcoin, the first and most well-known cryptocurrency, emerged in 2009 and laid the foundation for the crypto revolution. Since then, numerous cryptocurrencies, such as Ethereum, Ripple, and Litecoin, have emerged, each with its unique features and applications.

As cryptocurrency gains mainstream recognition, it has caught the attention of individuals, businesses, and governments worldwide. In the United States, both federal and state authorities have been grappling with its regulation and integration into existing financial systems. The potential benefits and risks associated with cryptocurrency make it a subject of intense debate and scrutiny.

Now, let’s dive deeper into the what, who, when, where, why, and how of cryptocurrency in the United States.

What is Cryptocurrency?

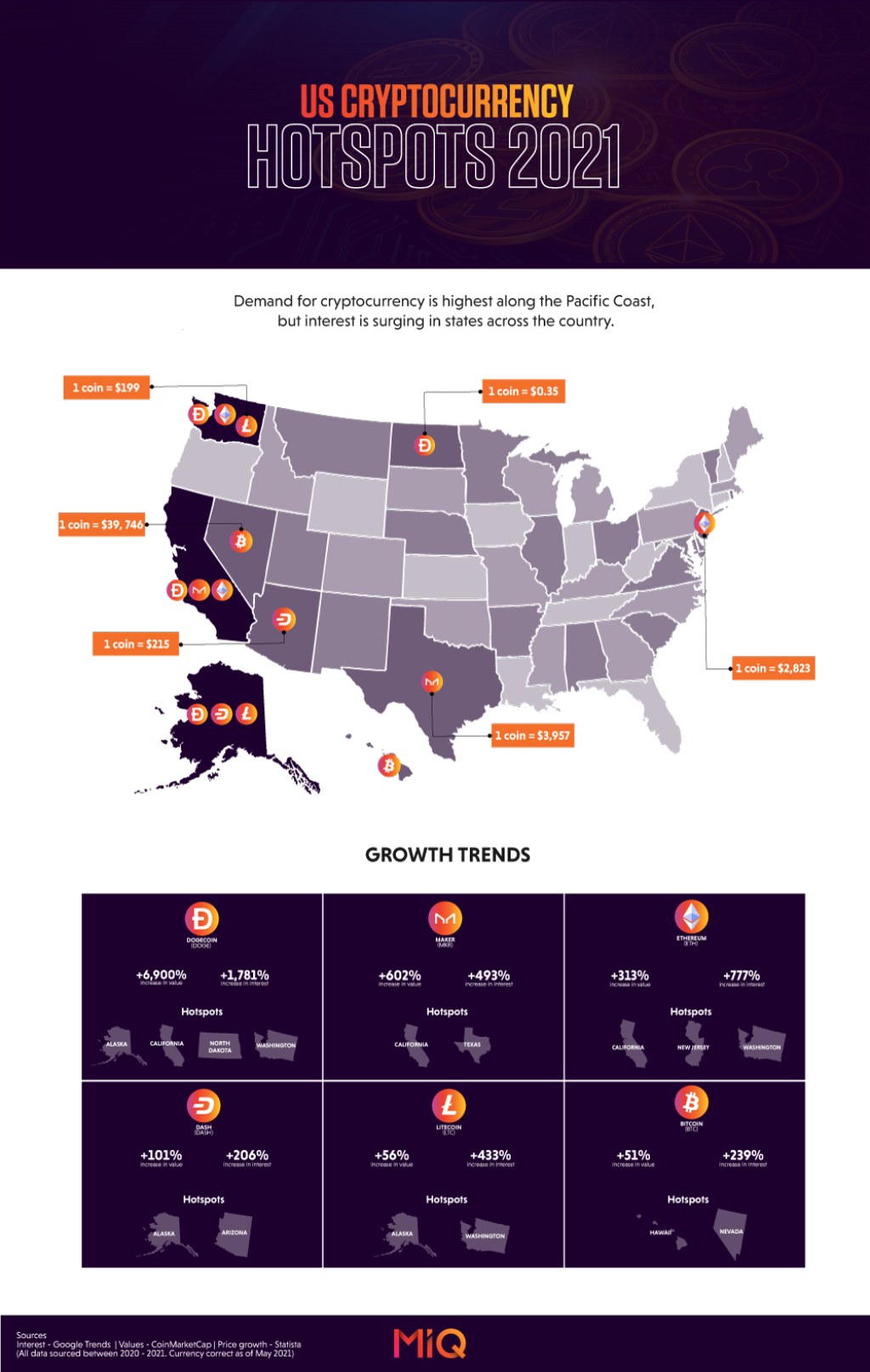

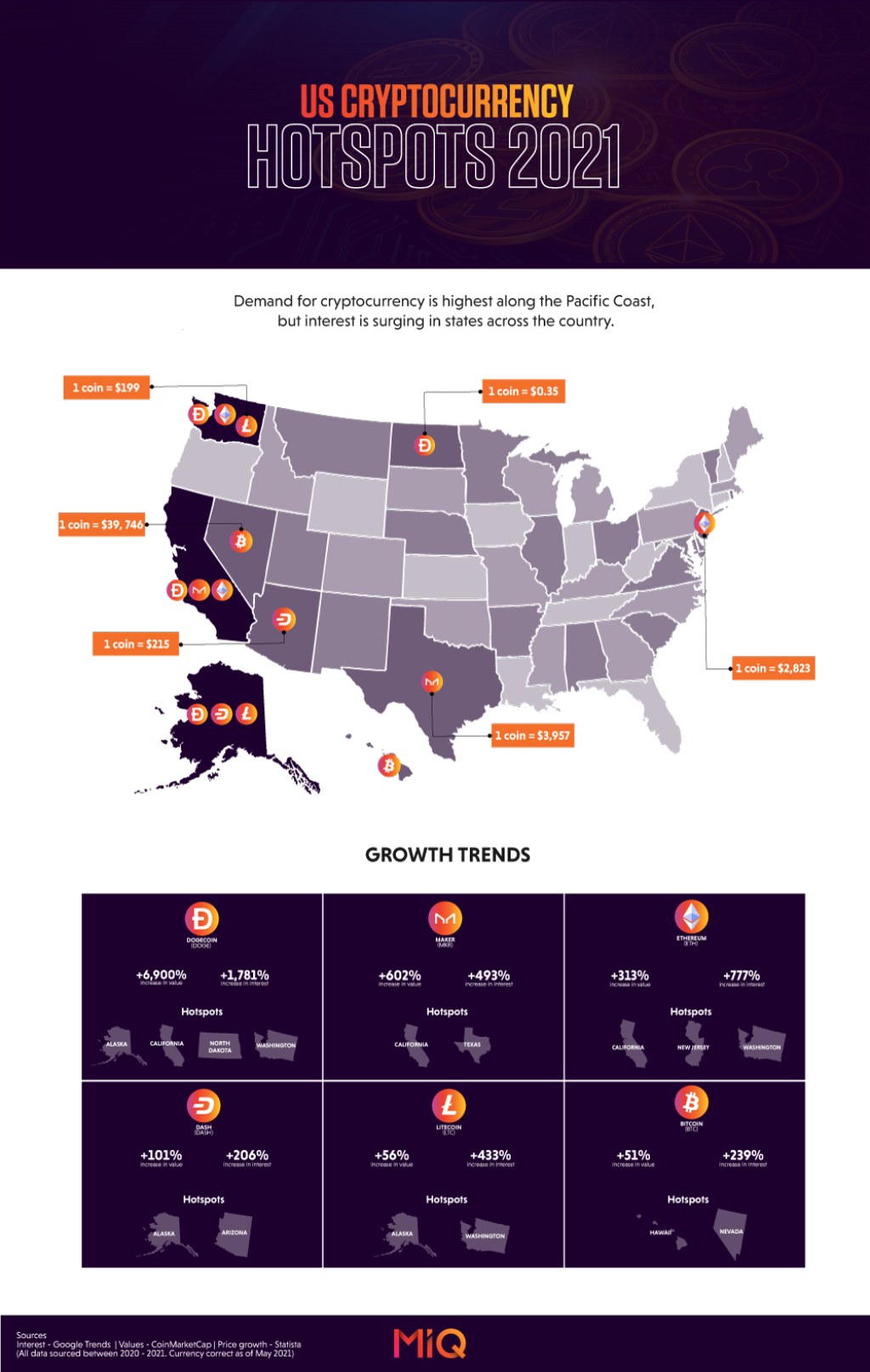

Image Source: wearemiq.com

⭐ Cryptocurrency is a digital form of currency that operates on a decentralized network called blockchain. It utilizes encryption techniques to secure transactions and control the creation of new units. Unlike traditional currencies, cryptocurrency is not issued or regulated by a central authority, such as a government or central bank.

Who Created Cryptocurrency?

⭐ The concept of cryptocurrency was introduced by an individual or a group of individuals known by the pseudonym Satoshi Nakamoto. In 2009, Nakamoto released a whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System, outlining the principles and mechanisms of the first cryptocurrency, Bitcoin.

When Did Cryptocurrency Emerge in the United States?

⭐ Cryptocurrency emerged in the United States shortly after the release of Bitcoin in 2009. Initially, it gained attention within tech-savvy communities and grew gradually in popularity. However, it wasn’t until several years later that cryptocurrency gained significant mainstream recognition and adoption.

Where Can You Use Cryptocurrency in the United States?

⭐ Cryptocurrency can be used in various ways across the United States. Some businesses and online retailers accept cryptocurrencies as a form of payment, allowing individuals to make purchases using their digital assets. Additionally, cryptocurrency exchanges provide platforms where users can trade different cryptocurrencies for traditional currencies or other digital assets.

Why is Cryptocurrency Popular in the United States?

⭐ Cryptocurrency’s popularity in the United States stems from several factors. Firstly, it offers individuals greater financial autonomy and control over their assets, bypassing the need for intermediaries like banks. Additionally, the potential for significant returns on investment has attracted many investors. Furthermore, the underlying blockchain technology has the potential to revolutionize various industries, leading to increased interest and adoption.

How Does Cryptocurrency Work in the United States?

⭐ Cryptocurrency relies on blockchain technology to facilitate transactions and maintain a secure ledger. When a transaction occurs, it is verified by network participants called miners, who ensure its validity and record it on the blockchain. This decentralized and transparent ledger ensures the integrity and immutability of transactions, making them resistant to fraud and manipulation.

Advantages and Disadvantages of Cryptocurrency in the United States

Advantages of Cryptocurrency

✅ Secure and Transparent Transactions: Cryptocurrency transactions are secured through encryption and recorded on a decentralized and transparent blockchain, minimizing the risk of fraud and ensuring transparency.

✅ Financial Autonomy: Cryptocurrency provides individuals with greater control over their funds, eliminating the need for intermediaries like banks and enabling direct peer-to-peer transactions.

✅ Potential for High Returns: Investments in certain cryptocurrencies have yielded significant returns, attracting investors seeking profitable opportunities.

✅ Technological Innovation: Cryptocurrency’s underlying technology, blockchain, has the potential to revolutionize various industries, offering increased efficiency, transparency, and security.

✅ Accessibility: Cryptocurrency allows individuals without access to traditional banking services to participate in the financial system and make digital transactions.

Disadvantages of Cryptocurrency

❌ Volatility: Cryptocurrency prices can be highly volatile, subjecting investors to significant market fluctuations and potential losses.

❌ Lack of Regulation: The decentralized nature of cryptocurrencies has posed challenges for regulatory bodies, leading to concerns regarding investor protection, money laundering, and illegal activities.

❌ Technical Complexity: Understanding and managing cryptocurrencies require a certain level of technical knowledge, which may deter some individuals from participating in this ecosystem.

❌ Security Risks: While blockchain technology provides security, individual users are susceptible to risks such as hacking, phishing, and scams.

❌ Limited Acceptance: Although the acceptance of cryptocurrency is growing, its adoption as a widely accepted form of payment is still limited compared to traditional currencies.

Frequently Asked Questions (FAQ)

1. Can I mine cryptocurrency in the United States?

Yes, mining cryptocurrency is possible in the United States. However, it requires specialized hardware, software, and a significant amount of computational power.

2. Are cryptocurrency transactions taxable in the United States?

Yes, cryptocurrency transactions are generally subject to taxation in the United States. The Internal Revenue Service (IRS) treats cryptocurrencies as property, and tax obligations apply to capital gains and losses from their sale or exchange.

3. Is it legal to buy goods and services with cryptocurrency in the United States?

Yes, it is legal to buy goods and services with cryptocurrency in the United States. However, the acceptance of cryptocurrency varies among businesses, and it may not be widely available as a payment option.

4. How can I secure my cryptocurrency holdings?

To secure your cryptocurrency holdings, it is essential to use secure wallets or hardware wallets that store your digital assets offline. Additionally, employing strong passwords, enabling two-factor authentication, and staying vigilant against phishing attempts are crucial.

5. Will cryptocurrency replace traditional currencies in the United States?

While the adoption of cryptocurrency is growing, it is unlikely to replace traditional currencies entirely in the near future. Cryptocurrency’s role is more likely to coexist alongside traditional currencies, offering a digital alternative for certain transactions.

Conclusion: Embracing the Future of Cryptocurrency

In conclusion, cryptocurrency has emerged as a disruptive force in the United States, challenging the traditional financial system and opening new avenues for financial inclusion and innovation. Its decentralized nature, underlying blockchain technology, and potential benefits have garnered significant attention. However, it is essential to navigate this evolving landscape with caution, considering the risks and legal implications associated with cryptocurrencies. As the world embraces the future of digital currencies, staying informed and making educated decisions will be key to reaping the rewards of this transformative technology.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only. It should not be construed as financial or investment advice. Cryptocurrency investments carry risks, and individuals should conduct their own research and seek professional advice before making any investment decisions.

This post topic: Blockchain Insights