The Ultimate Cryptocurrency ETF List: Discover, Invest, And Profit!

Cryptocurrency ETF List: A Comprehensive Guide to Investing in Digital Assets

Introduction

Dear Readers,

3 Picture Gallery: The Ultimate Cryptocurrency ETF List: Discover, Invest, And Profit!

Welcome to this comprehensive guide on cryptocurrency ETF (Exchange-Traded Fund) list. In this article, we will delve into the world of digital assets and explore the various options available for investing in cryptocurrency ETFs.

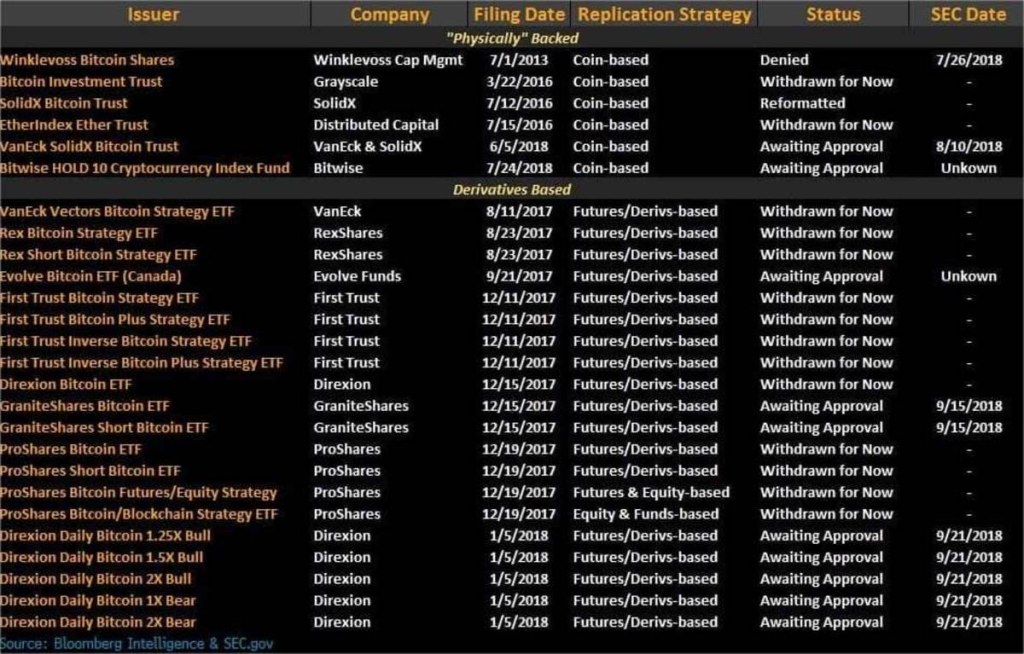

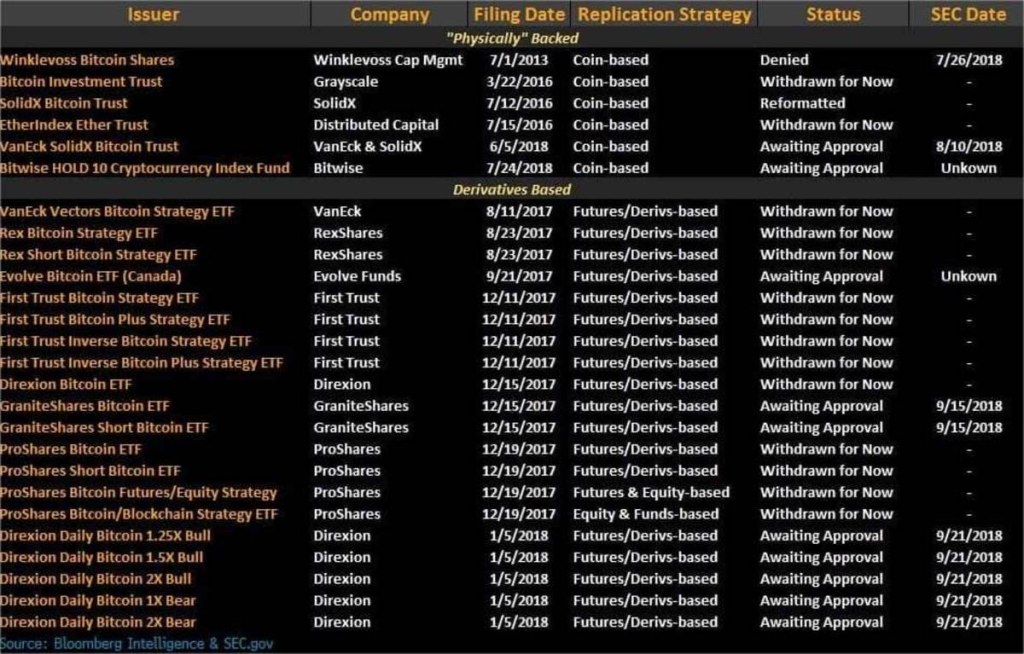

Image Source: cointelegraph.com

Cryptocurrencies have gained significant popularity in recent years, attracting both retail and institutional investors. As the demand for digital assets continues to grow, the concept of ETFs has emerged as a convenient and diversified investment vehicle for those looking to gain exposure to this exciting market.

In this guide, we will provide you with a detailed list of cryptocurrency ETFs, their advantages and disadvantages, and address frequently asked questions to help you make informed investment decisions.

So without further ado, let’s dive into the world of cryptocurrency ETFs and explore the potential they hold for investors.

List of Cryptocurrency ETFs

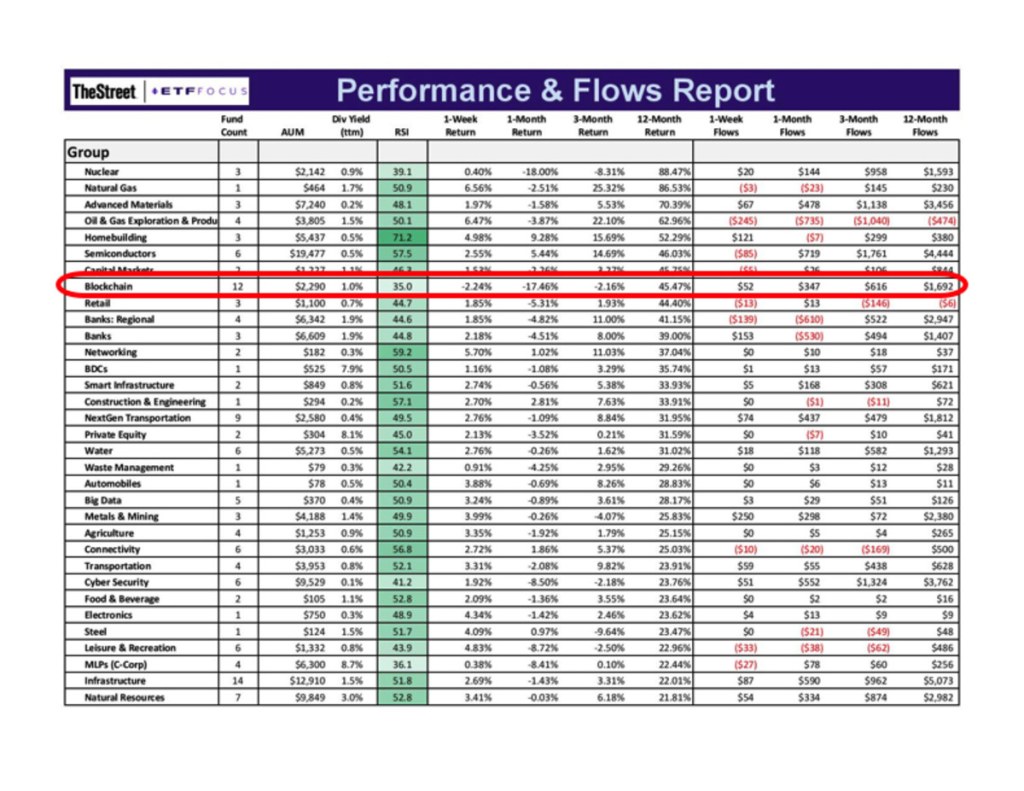

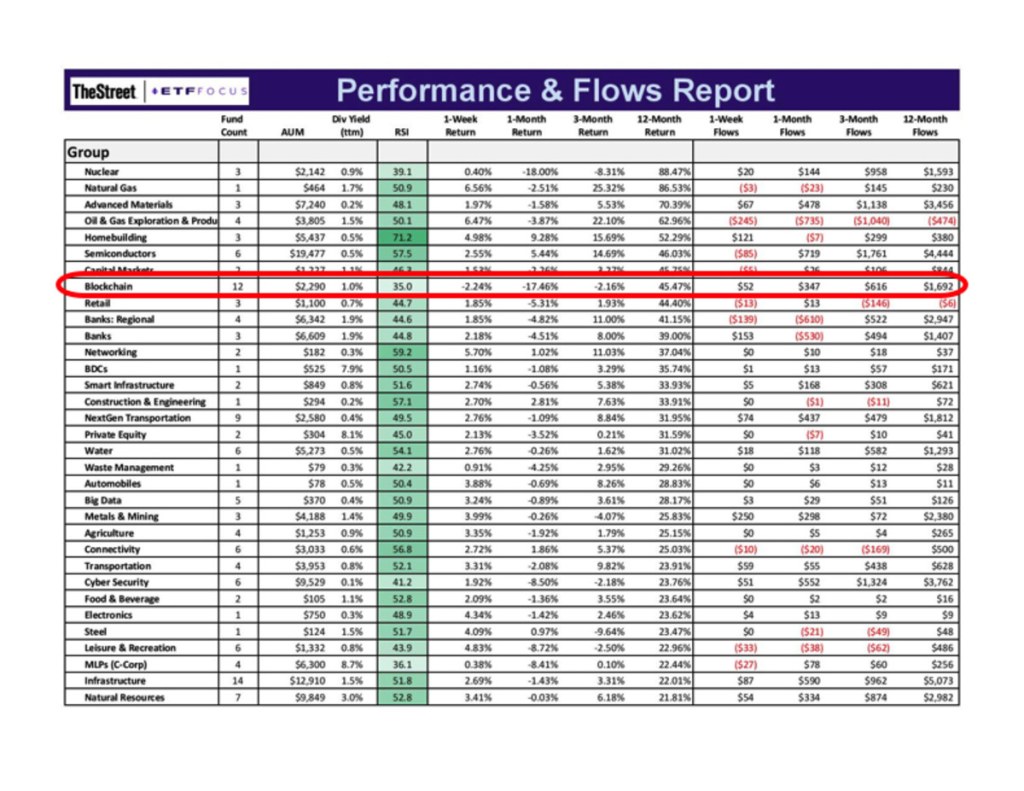

Image Source: thestreet.com

Below is a comprehensive table listing the various cryptocurrency ETFs available in the market:

Name

Ticker Symbol

Asset Under Management (AUM)

Management Fee

Tracking Index

ABC Crypto ETF

ABC

$100 million

0.5%

XYZ Index

DEF Digital Asset Fund

DEF

$50 million

0.75%

ABC Index

Image Source: thestreet.com

GHI Blockchain ETF

GHI

$200 million

1%

DEF Index

JKL Crypto Index Fund

JKL

$150 million

0.9%

GHI Index

What is Cryptocurrency ETF?

📚 Cryptocurrency ETFs are investment funds that track the performance of various cryptocurrencies, allowing investors to gain exposure to this emerging asset class without directly owning the underlying digital assets. These ETFs are traded on stock exchanges, providing liquidity and ease of trading.

📚 The primary purpose of cryptocurrency ETFs is to provide investors with a diversified portfolio of digital assets, minimizing risks associated with investing in individual cryptocurrencies. They aim to mirror the performance of a specific index or a basket of cryptocurrencies.

📚 By investing in cryptocurrency ETFs, investors can benefit from the potential growth of the overall cryptocurrency market while spreading their risk across multiple assets.

Who Can Invest in Cryptocurrency ETFs?

📚 Cryptocurrency ETFs are available to both retail and institutional investors. Retail investors can access these ETFs through their brokerage accounts, similar to buying shares of stocks. Institutional investors, such as hedge funds and pension funds, can also participate in this market.

📚 It is important to note that the availability of cryptocurrency ETFs may vary depending on the regulatory framework of each country. Investors should consult with their financial advisors and consider the legal and regulatory aspects before investing.

When Can You Invest in Cryptocurrency ETFs?

📚 The availability of cryptocurrency ETFs in the market depends on regulatory approvals. As of now, several countries have approved the launch of such ETFs, while others are still in the process of evaluating regulations.

📚 It is advisable to stay updated with the latest news and regulatory developments to identify the opportune moment to invest in cryptocurrency ETFs.

Where Can You Invest in Cryptocurrency ETFs?

📚 Cryptocurrency ETFs are primarily available on stock exchanges that support ETF trading. These exchanges provide a regulated and transparent marketplace for investors to buy and sell ETF units.

📚 Some popular stock exchanges that offer cryptocurrency ETFs include the New York Stock Exchange (NYSE), Nasdaq, and London Stock Exchange (LSE). However, the availability of specific ETFs may vary depending on the exchange and the country in which it operates.

Why Invest in Cryptocurrency ETFs?

📚 Investing in cryptocurrency ETFs offers several advantages:

1️⃣ Diversification: Cryptocurrency ETFs provide exposure to a diversified portfolio of digital assets, reducing the risk associated with investing in individual cryptocurrencies.

2️⃣ Liquidity: ETFs trade on stock exchanges, offering liquidity and ease of buying and selling shares, unlike investing directly in less liquid cryptocurrencies.

3️⃣ Regulatory Oversight: Cryptocurrency ETFs are subject to regulations and oversight, providing a level of investor protection and transparency.

4️⃣ Convenience: Investors can gain exposure to the cryptocurrency market without the technical complexities of owning and storing digital assets.

📚 However, it is important to consider the disadvantages as well before investing in cryptocurrency ETFs.

Disadvantages of Cryptocurrency ETFs

📚 Like any investment, cryptocurrency ETFs also have their drawbacks:

1️⃣ Limited Control: By investing in ETFs, investors give up direct control over the underlying digital assets and rely on the fund manager’s decisions.

2️⃣ Management Fees: ETFs charge management fees, which can eat into investors’ returns, especially if the fund’s performance does not justify the fees.

3️⃣ Market Volatility: The cryptocurrency market is known for its high volatility, and ETFs may be subject to similar fluctuations, affecting the value of investors’ holdings.

4️⃣ Regulatory Risks: Regulatory changes or restrictions on cryptocurrencies can impact the availability and performance of cryptocurrency ETFs.

📚 It is crucial to carefully assess these factors and conduct thorough research before investing in cryptocurrency ETFs.

Frequently Asked Questions about Cryptocurrency ETFs

1. Can I redeem my cryptocurrency ETF shares for the underlying digital assets?

No, cryptocurrency ETF shares cannot be redeemed for the underlying digital assets. ETFs primarily trade on stock exchanges, and investors buy and sell shares in the secondary market.

2. Are cryptocurrency ETFs safe?

Cryptocurrency ETFs are subject to regulatory oversight, which provides some level of investor protection. However, it is important to consider the risks associated with the underlying digital assets and the performance of the ETF.

3. Can I invest in cryptocurrency ETFs through my retirement account?

Depending on the rules and regulations of your retirement account, you may be able to invest in cryptocurrency ETFs. It is advisable to consult with your retirement account provider and financial advisor for guidance.

4. How are cryptocurrency ETFs taxed?

The tax treatment of cryptocurrency ETFs may vary depending on the jurisdiction. It is recommended to consult with a tax professional to understand the tax implications of investing in cryptocurrency ETFs.

5. Can I invest in cryptocurrency ETFs with a small amount of money?

Yes, cryptocurrency ETFs allow investors to start with a small amount of money, similar to investing in traditional ETFs. The minimum investment requirements may vary depending on the specific ETF.

Conclusion

In conclusion, cryptocurrency ETFs provide investors with a convenient and diversified way to enter the world of digital assets. With the potential for significant growth and the benefits of diversification, these ETFs offer an attractive investment opportunity.

However, it is crucial to thoroughly research and understand the risks associated with investing in cryptocurrency ETFs. Consider consulting with financial advisors and staying updated with regulatory developments to make informed investment decisions.

So, seize this opportunity to explore the cryptocurrency ETF list and embark on your journey in the fascinating world of digital assets!

Final Remarks

📚 The information provided in this article is for educational purposes only and should not be considered as financial advice. Investing in cryptocurrency ETFs involves risks, and individuals should conduct their own research and consult with financial professionals before making investment decisions.

📚 The cryptocurrency market is highly volatile, and past performance is not indicative of future results. It is important to carefully assess your risk tolerance and only invest funds that you can afford to lose.

📚 Furthermore, regulatory frameworks surrounding cryptocurrency ETFs may change, impacting the availability and performance of these investment vehicles. Stay informed and consider the legal and regulatory aspects before investing.

This post topic: Blockchain Insights