Unlocking Profit Potential: Mastering Cryptocurrency Arbitrage For Maximum Returns

Cryptocurrency Arbitrage: Maximizing Profits in the Digital Currency Market

Greetings, Readers! Today, we delve into the world of cryptocurrency arbitrage, a strategy that has gained significant traction among investors seeking to capitalize on the volatility and price discrepancies in the digital currency market. In this article, we will explore the concept of cryptocurrency arbitrage, its key players, when and where it is most effective, and why it has become such a popular investment strategy. Additionally, we will examine the advantages and disadvantages of cryptocurrency arbitrage, answer some frequently asked questions, and provide you with a call to action. So, let’s get started!

Introduction

Cryptocurrency arbitrage is a trading technique that involves taking advantage of price differences between different cryptocurrency exchanges. By purchasing a digital asset on one exchange at a lower price and selling it on another exchange at a higher price, traders can profit from these price disparities. This strategy has gained popularity due to the decentralized nature of digital currencies, which allows for variations in pricing across different platforms.

3 Picture Gallery: Unlocking Profit Potential: Mastering Cryptocurrency Arbitrage For Maximum Returns

1. What is Cryptocurrency Arbitrage? 🤔

Cryptocurrency arbitrage involves exploiting the price discrepancies of digital assets across different exchanges to make a profit. Traders take advantage of these price differences by purchasing a cryptocurrency on one exchange at a lower price and selling it on another exchange at a higher price, pocketing the price differential as profit.

2. Who Can Engage in Cryptocurrency Arbitrage? 🕴️

Image Source: blockgeeks.com

Anyone can engage in cryptocurrency arbitrage, from individual retail investors to institutional traders. However, it requires a deep understanding of the digital currency market, access to multiple exchanges, and the ability to execute trades swiftly. Traders also need to be aware of the potential risks associated with this strategy.

3. When is Cryptocurrency Arbitrage Most Effective? ⌛

Cryptocurrency arbitrage is most effective during periods of high volatility in the digital currency market. When prices fluctuate rapidly, the price differences between exchanges become more pronounced, presenting lucrative opportunities for arbitrage traders. However, it is important to note that as the market matures, these opportunities may become less frequent and profitable.

4. Where Can Cryptocurrency Arbitrage be Executed? 🌍

Cryptocurrency arbitrage can be executed on various exchanges that offer different cryptocurrencies. Traders can take advantage of price disparities within the same country or across different countries, depending on their access to these exchanges and the regulations surrounding digital currencies in each jurisdiction.

Image Source: website-files.com

5. Why Has Cryptocurrency Arbitrage Become Popular? 🚀

Cryptocurrency arbitrage has become popular due to the potential for high profits in a relatively short period. The decentralized nature of cryptocurrencies and the availability of numerous exchanges create opportunities for price differences, making it an attractive strategy for traders. Additionally, the 24/7 nature of the digital currency market allows for continuous trading and the potential for increased profits.

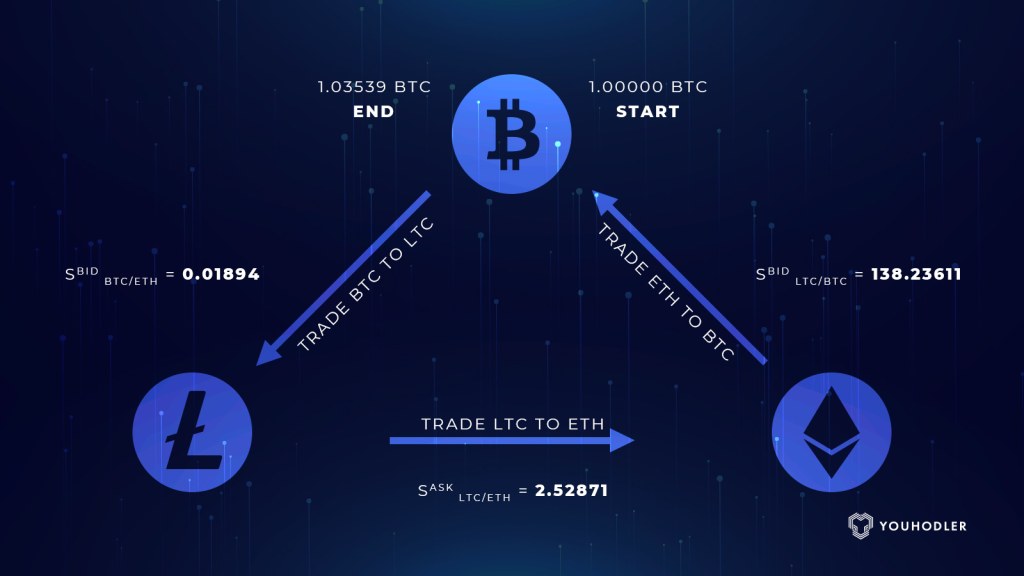

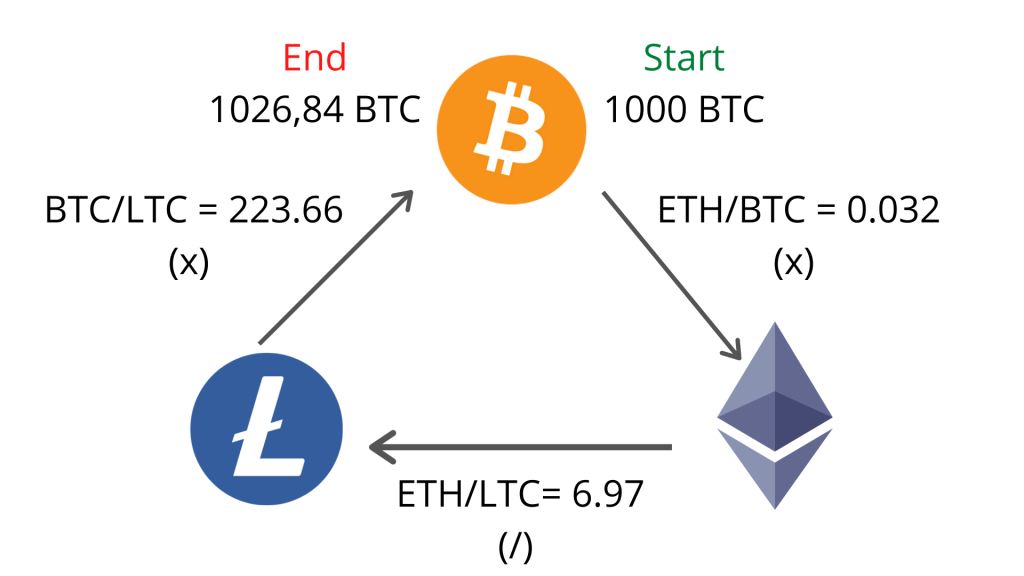

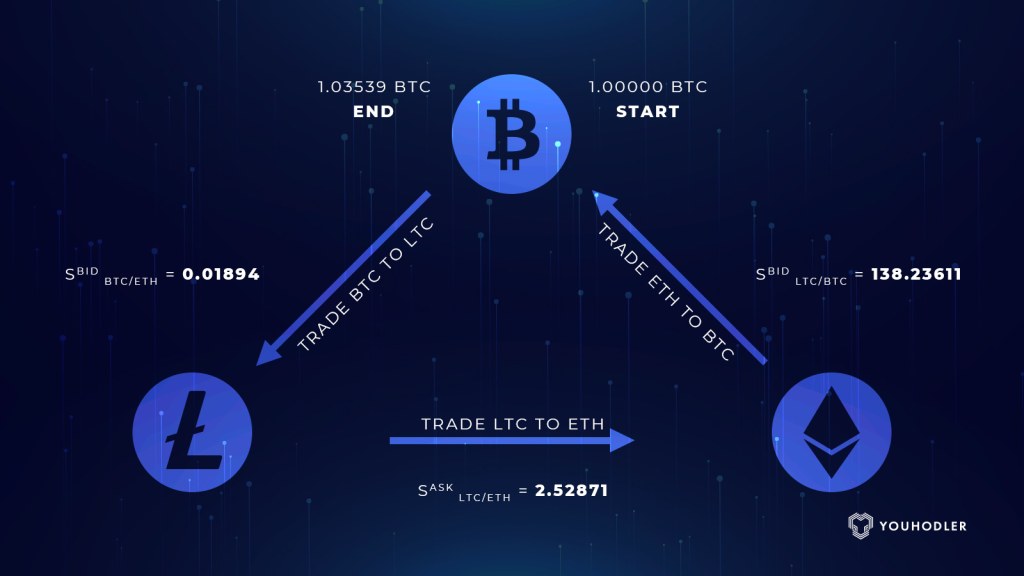

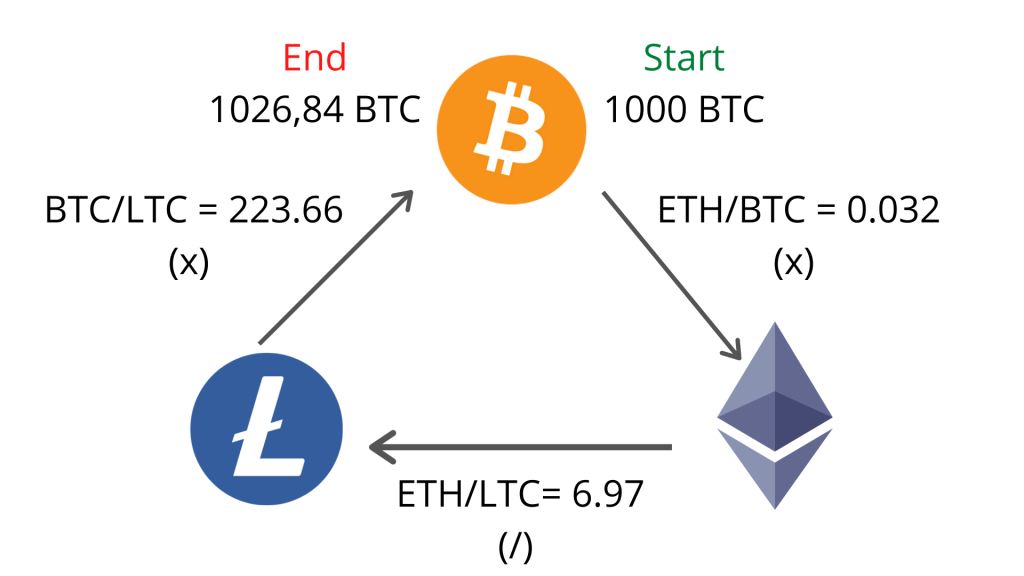

6. How Does Cryptocurrency Arbitrage Work? 🔄

Cryptocurrency arbitrage involves several steps. First, traders identify price disparities between exchanges by monitoring market prices. Once a profitable opportunity is identified, they simultaneously buy the cryptocurrency at a lower price on one exchange and sell it at a higher price on another exchange. The success of this strategy relies on the speed of execution and the ability to transfer funds between exchanges quickly.

Advantages and Disadvantages of Cryptocurrency Arbitrage

Advantages:

Image Source: algotrading101.com

1. Potential for High Profits: Cryptocurrency arbitrage offers the potential for substantial profits, especially during periods of high market volatility.

2. Diversification of Risk: Engaging in arbitrage allows traders to diversify their investment portfolio and mitigate risk by exploiting price differences across multiple exchanges.

3. 24/7 Trading Opportunities: With the digital currency market operating 24/7, traders can execute arbitrage trades at any time, maximizing the potential for profit.

4. Capitalizing on Inefficiencies: Cryptocurrency arbitrage takes advantage of pricing inefficiencies within the digital currency market, allowing traders to profit from these temporary imbalances.

5. Increased Liquidity: By facilitating the movement of digital assets between exchanges, cryptocurrency arbitrage contributes to overall market liquidity.

Disadvantages:

1. Market Volatility: While volatility can be advantageous for arbitrage opportunities, it also poses a significant risk. Sudden price fluctuations can result in losses if trades are not executed promptly.

2. Trading Fees: Exchanges often charge fees for executing trades, reducing potential profits from arbitrage strategies.

3. Technical Challenges: Engaging in cryptocurrency arbitrage requires technical expertise and access to multiple exchanges, which may pose challenges for novice traders.

4. Regulatory Risks: The regulatory landscape surrounding cryptocurrencies is continually evolving, and changes in regulations can impact the viability of arbitrage strategies.

5. Limited Opportunities: As the cryptocurrency market matures and becomes more efficient, profitable arbitrage opportunities may become scarcer.

Frequently Asked Questions (FAQ)

1. Is cryptocurrency arbitrage risk-free?

No, cryptocurrency arbitrage carries risks, including market volatility and potential delays in executing trades.

2. How can I find profitable arbitrage opportunities?

Traders can use specialized arbitrage bots or manually monitor prices on multiple exchanges to identify profitable opportunities.

3. Are there any legal concerns associated with cryptocurrency arbitrage?

The legality of cryptocurrency arbitrage varies across jurisdictions. Traders should familiarize themselves with the regulations in their respective countries.

4. Can I engage in arbitrage with any cryptocurrency?

Arbitrage opportunities exist for various cryptocurrencies, but traders should consider liquidity and transaction speeds when selecting assets.

5. What other strategies can complement cryptocurrency arbitrage?

Hedging, swing trading, and long-term investing are strategies that can complement cryptocurrency arbitrage and provide additional revenue streams.

Conclusion

In conclusion, cryptocurrency arbitrage offers an opportunity for traders to exploit price differences across different exchanges, potentially yielding substantial profits. While it requires a deep understanding of the market, technical expertise, and quick execution, the advantages of cryptocurrency arbitrage, such as high profit potential and diversification of risk, make it an attractive strategy for both individual and institutional traders. However, it is essential to consider the disadvantages, including market volatility, trading fees, and regulatory risks. To embark on this journey, we encourage you to conduct thorough research, stay updated on market trends, and consider consulting with experienced professionals. Happy arbitraging!

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Cryptocurrency trading carries inherent risks, and readers are encouraged to exercise caution and conduct their own research before engaging in any trading activities.

This post topic: Blockchain Insights