CryptoTaxPro: The Ultimate Cryptocurrency Tax Calculator – Simplify Your Crypto Taxes Today!

Cryptocurrency Tax Calculator: Simplifying Tax Filing for Crypto Investors

Introduction

Dear Readers,

2 Picture Gallery: CryptoTaxPro: The Ultimate Cryptocurrency Tax Calculator – Simplify Your Crypto Taxes Today!

Welcome to an informative article that aims to simplify the complex world of cryptocurrency taxes. As the popularity of cryptocurrencies continues to soar, it becomes imperative for investors to understand their tax liabilities. In this article, we will introduce you to the concept of a cryptocurrency tax calculator, its benefits, pros and cons, and provide answers to frequently asked questions. So, let’s delve into the world of cryptocurrency tax calculations.

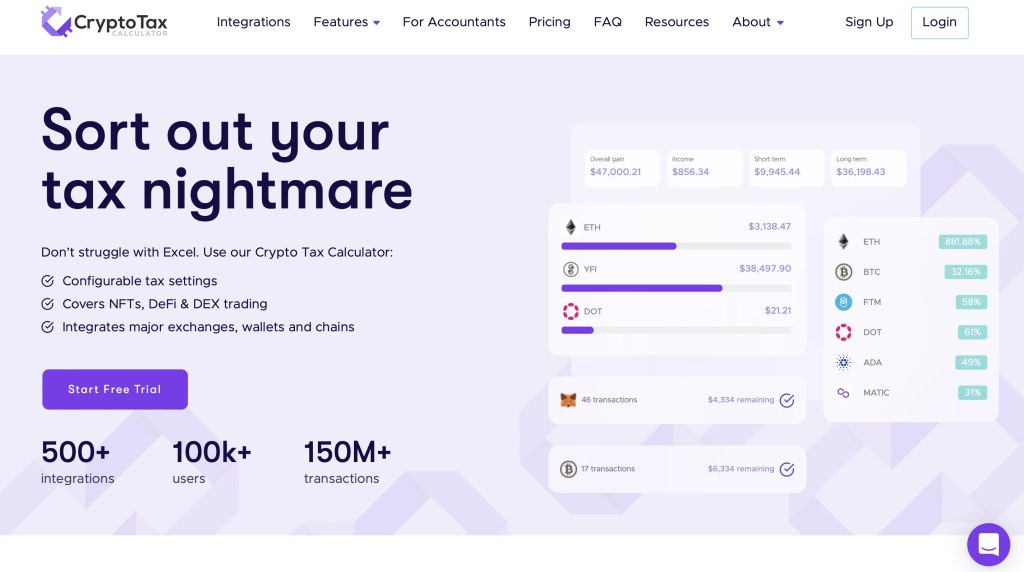

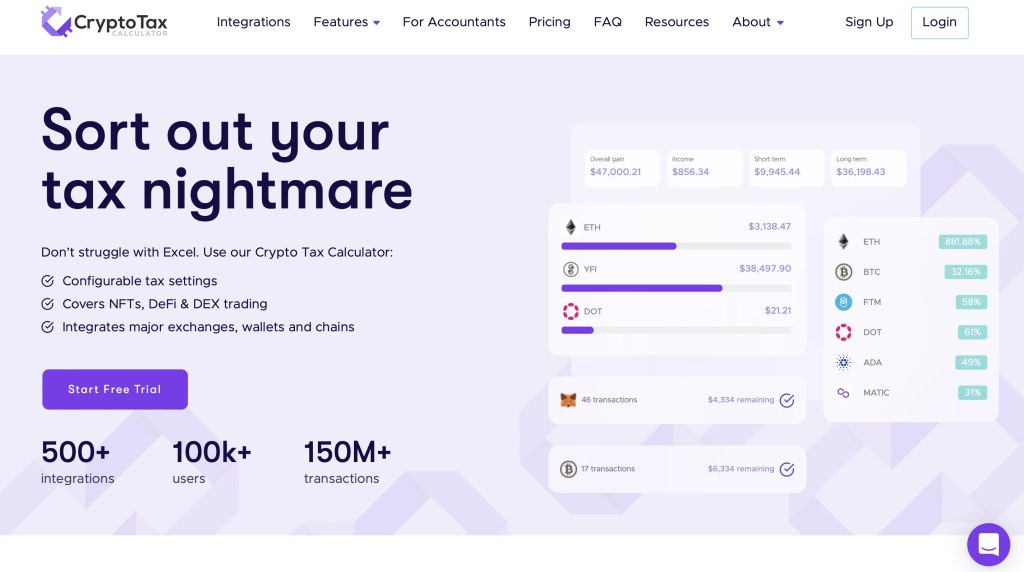

Image Source: prismic.io

Best regards,

Your friends at the Crypto Insights team

Overview

In recent years, cryptocurrencies have gained significant traction among investors, offering lucrative opportunities. However, the complex tax regulations surrounding cryptocurrencies can be daunting. Keeping track of transactions, calculating profits and losses, and reporting them accurately can be a time-consuming and error-prone process. This is where a cryptocurrency tax calculator comes to the rescue.

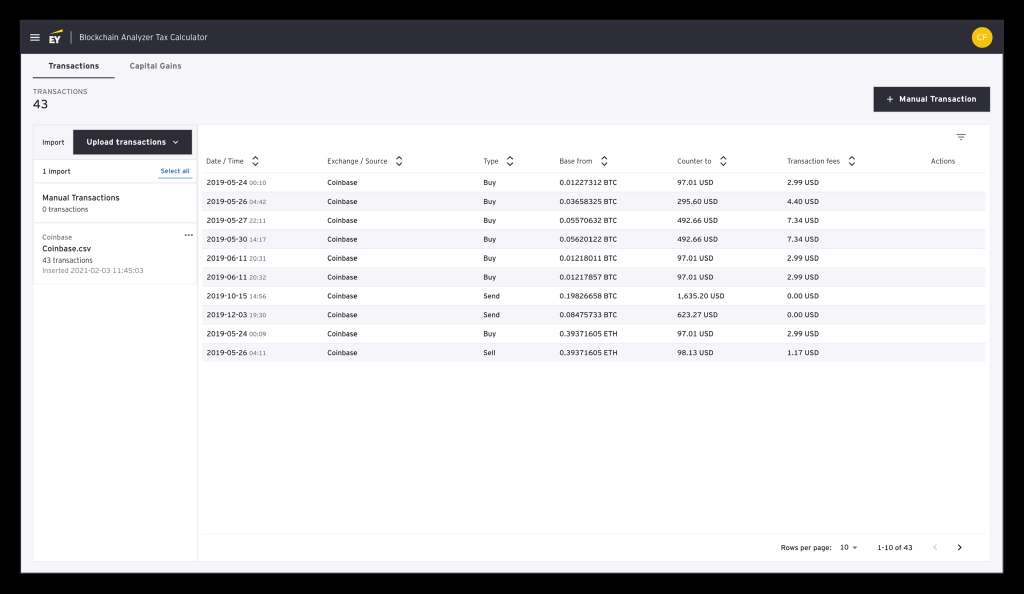

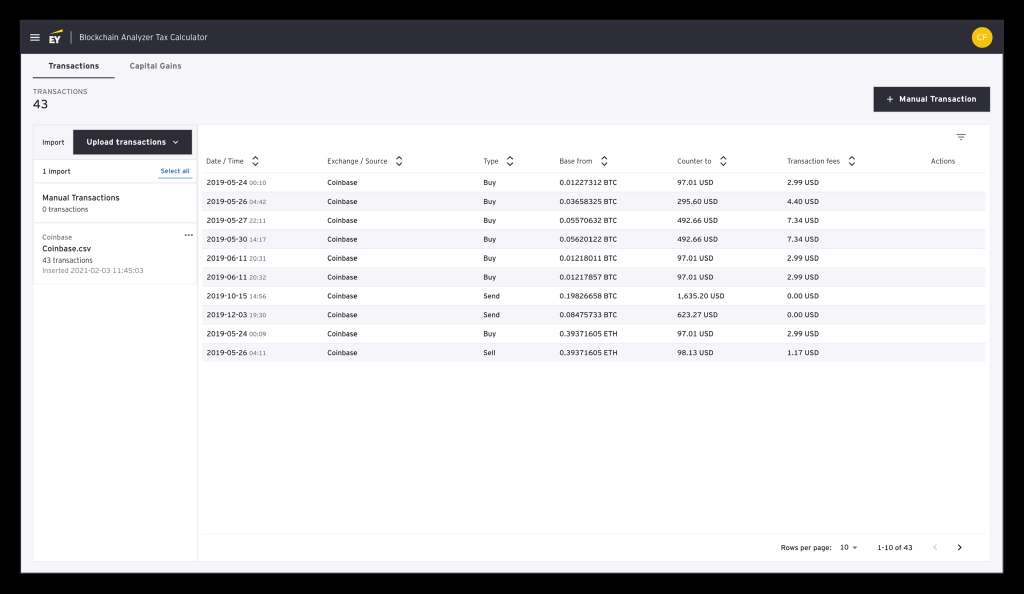

Image Source: influencermarketinghub.com

A cryptocurrency tax calculator is a specialized tool that simplifies the process of calculating tax liabilities for crypto investors. By automatically gathering transaction data from various cryptocurrency exchanges and wallets, these calculators provide accurate calculations, taking into account factors such as capital gains, losses, and applicable tax rates. Let us now dive deeper into the details of this powerful tool.

What is a Cryptocurrency Tax Calculator? 💡

A cryptocurrency tax calculator is a software or online tool that automates the process of calculating tax obligations for individuals who hold or trade cryptocurrencies. These calculators consider various tax regulations, including capital gains and losses, taxable events, and applicable tax rates. By integrating with multiple exchanges and wallets, they can accurately calculate tax liabilities and generate reports for easy filing.

Who Should Use a Cryptocurrency Tax Calculator? 🤔

Image Source: assets.ey.com

Any individual who buys, sells, or holds cryptocurrencies should consider using a cryptocurrency tax calculator. Whether you are a casual investor or a full-time trader, accurately calculating and reporting your tax obligations is crucial to avoid penalties and legal consequences. Additionally, tax calculators can benefit accountants and tax professionals who handle cryptocurrency taxes for multiple clients.

When Should You Use a Cryptocurrency Tax Calculator? ⏰

A cryptocurrency tax calculator should be used when you are ready to file your tax returns. It is recommended to start using the calculator well in advance of the tax filing deadline to ensure all transactions are accurately recorded. Regularly updating the calculator with new trades and transactions will enable you to stay organized and avoid any last-minute rush during tax season.

Where Can You Find a Cryptocurrency Tax Calculator? 🌍

Several cryptocurrency tax calculators are available online, offering different features and pricing plans. It is important to choose a reputable and reliable calculator that suits your specific needs. Some popular options include CoinTracking, CryptoTrader.Tax, and Bitcoin.Tax. You can access these tools via their respective websites or mobile applications, making it convenient to calculate taxes on the go.

Why Should You Use a Cryptocurrency Tax Calculator? 📈📉

Using a cryptocurrency tax calculator offers several advantages:

1. Accuracy: These calculators eliminate the chances of manual errors and provide precise tax calculations.

2. Time-saving: By automating the tax calculation process, these tools save considerable time and effort.

3. Compliance: Cryptocurrency tax calculators ensure that you are compliant with tax regulations and avoid penalties.

4. Detailed Reports: These calculators generate comprehensive reports that can be easily shared with tax professionals or used for personal reference.

5. Portfolio Insights: Many tax calculators offer additional features such as portfolio tracking, performance analysis, and tax optimization strategies.

Disadvantages of Using a Cryptocurrency Tax Calculator

While there are several benefits, it is also important to consider the potential drawbacks of using a cryptocurrency tax calculator:

1. Cost: Some tax calculators may charge a fee for their services, especially for more advanced features and larger transaction volumes.

2. Incomplete Integration: Not all tax calculators support integration with every cryptocurrency exchange or wallet, potentially leading to incomplete data.

3. Complex Transactions: Certain complex transactions, such as margin trading or participation in Initial Coin Offerings (ICOs), may not be accurately handled by all calculators.

4. Limited Jurisdiction Support: Tax regulations vary across different jurisdictions, and some calculators may not cater to specific country-specific tax requirements.

5. Data Security: As tax calculators handle sensitive financial information, it is crucial to choose a reputable calculator that prioritizes data security and privacy.

Frequently Asked Questions (FAQ)

Q: Is cryptocurrency tax calculation mandatory?

A: Yes, tax authorities in most countries require individuals to report their cryptocurrency transactions and calculate tax liabilities.

Q: How often should I update my cryptocurrency tax calculator?

A: It is recommended to update your tax calculator regularly, preferably after each cryptocurrency transaction or trade.

Q: Can I use a cryptocurrency tax calculator for previous years?

A: Yes, many tax calculators offer the option to calculate taxes for multiple years, allowing you to rectify any past filing errors.

Q: What documents do I need to use a cryptocurrency tax calculator?

A: You will typically need access to your cryptocurrency exchange and wallet transaction histories, which can be exported as CSV or API files.

Q: Can I use a cryptocurrency tax calculator for business purposes?

A: Some tax calculators offer business-oriented features, allowing you to calculate taxes for crypto-related business activities as well.

Conclusion

In conclusion, a cryptocurrency tax calculator is a powerful tool that simplifies the often complex process of calculating tax liabilities for crypto investors. By automating the calculations and providing accurate reports, these tools save time, ensure compliance, and offer valuable insights into your cryptocurrency portfolio. Remember to choose a reliable calculator that suits your needs and consult with a tax professional for specific advice. Embrace the power of technology and make your cryptocurrency tax filing a seamless and stress-free experience!

We hope this article has shed light on the importance of cryptocurrency tax calculators and how they can benefit you. Start using a reliable calculator today and take control of your cryptocurrency taxes!

Final Remarks

Disclaimer: This article is for informational purposes only and should not be considered legal or financial advice. Cryptocurrency tax regulations vary across jurisdictions, and it is important to consult with a qualified tax professional or accountant for personalized guidance. Remember to comply with your local tax laws and report your cryptocurrency transactions accurately.

Thank you for reading!

The Crypto Insights team

This post topic: Blockchain Insights