The Ultimate Guide To Cryptocurrency Future Predictions: Unveiling The Path To Financial Success

Cryptocurrency Future Predictions

Introduction

Dear Readers,

3 Picture Gallery: The Ultimate Guide To Cryptocurrency Future Predictions: Unveiling The Path To Financial Success

Welcome to our informative article on the future predictions of cryptocurrency. In this fast-paced digital era, cryptocurrencies have gained immense popularity and have become a hot topic of discussion. In this article, we will provide you with valuable insights and predictions about the future of cryptocurrencies. So, fasten your seatbelts and join us on this exciting journey into the world of digital currencies.

Image Source: finyear.com

1️⃣ Cryptocurrency Market Overview and Growth

2️⃣ Regulation and Government Adoption of Cryptocurrencies

3️⃣ Technological Advancements and Innovation in the Cryptocurrency Space

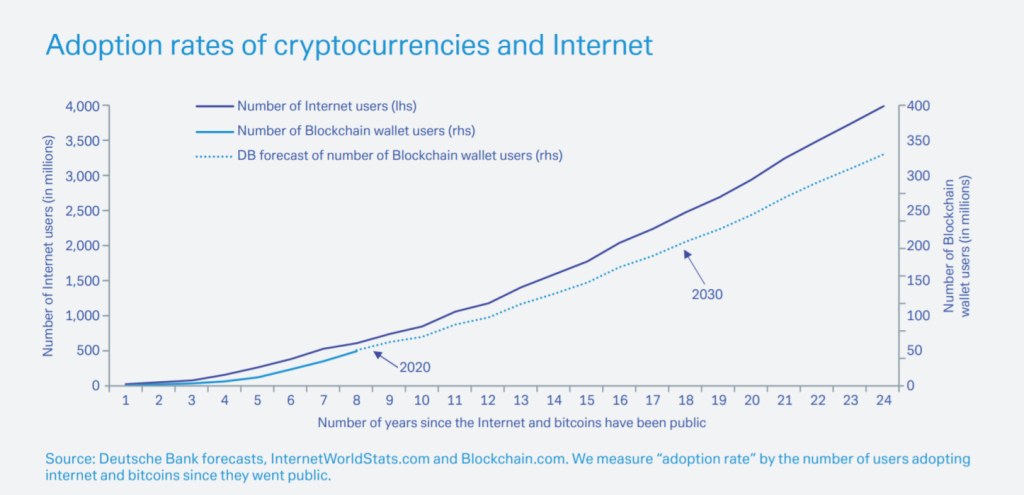

Image Source: telegra.ph

4️⃣ Adoption by Mainstream Industries and Businesses

5️⃣ Cryptocurrency as a Global Payment Solution

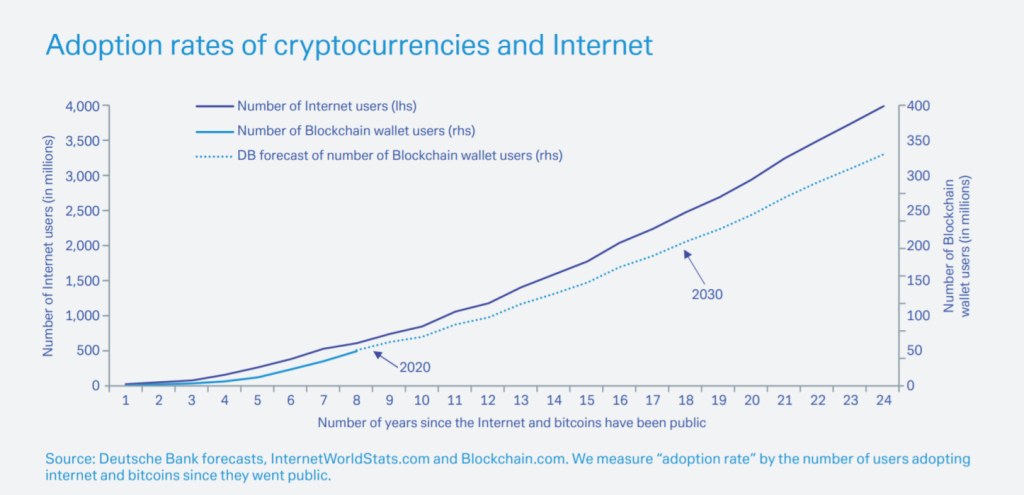

Image Source: 101blockchains.com

6️⃣ Environmental Impact of Cryptocurrencies

7️⃣ Potential Risks and Challenges

Cryptocurrency Market Overview and Growth

The cryptocurrency market has experienced tremendous growth over the past decade. Bitcoin, the first and most popular cryptocurrency, paved the way for the development of numerous other digital currencies. Market experts predict that the cryptocurrency market will continue to grow in the coming years, fueled by increasing adoption and technological advancements.

Furthermore, the market capitalization of cryptocurrencies has reached astronomical figures, attracting both individual investors and institutional players. The decentralized nature of cryptocurrencies offers transparency, security, and accessibility, making them an attractive investment option for many.

However, it is important to note that the cryptocurrency market is highly volatile, with prices fluctuating rapidly. Investors should exercise caution and conduct thorough research before making any investment decisions.

Regulation and Government Adoption of Cryptocurrencies

Government regulations play a crucial role in shaping the future of cryptocurrencies. Many countries have already implemented regulations to govern the use and trading of cryptocurrencies, while others are still in the process of formulating their policies.

Government adoption of cryptocurrencies has the potential to bring about increased legitimacy and stability to the market. Some countries are exploring the possibility of launching their own national digital currencies, which could further drive the widespread adoption of cryptocurrencies.

However, regulatory measures should strike a balance between protecting investors and fostering innovation. Stricter regulations may hinder the growth of the cryptocurrency market, while too lenient regulations could lead to fraud and security risks.

Technological Advancements and Innovation in the Cryptocurrency Space

The world of cryptocurrencies is constantly evolving, with new technological advancements and innovations being introduced regularly. Blockchain technology, the underlying technology behind cryptocurrencies, is being utilized in various industries beyond finance.

Developments such as smart contracts, decentralized applications (DApps), and interoperability between different blockchain networks are revolutionizing the way business transactions are conducted. These advancements have the potential to increase the efficiency, security, and scalability of cryptocurrencies, making them more practical for everyday use.

Furthermore, the integration of artificial intelligence and machine learning in cryptocurrency trading and investment platforms is expected to enhance market analysis and prediction capabilities, providing investors with valuable insights for making informed decisions.

Adoption by Mainstream Industries and Businesses

As cryptocurrencies gain more recognition and acceptance, mainstream industries and businesses are beginning to incorporate them into their operations. Major companies such as Tesla, PayPal, and Microsoft have started accepting cryptocurrencies as a form of payment, signaling a shift towards mainstream adoption.

The integration of cryptocurrencies into existing payment systems has the potential to streamline transactions, reduce costs, and increase financial inclusivity. Additionally, the use of blockchain technology in supply chain management, healthcare, and identity verification offers enhanced transparency, security, and efficiency.

However, challenges such as scalability, regulatory compliance, and user experience need to be addressed for widespread adoption of cryptocurrencies by mainstream industries.

Cryptocurrency as a Global Payment Solution

The decentralized nature of cryptocurrencies allows for borderless and frictionless transactions, making them an ideal global payment solution. Cryptocurrencies have the potential to eliminate intermediaries, reduce transaction fees, and facilitate instant cross-border transfers.

With increasing globalization and the rise of e-commerce, the demand for efficient and secure payment methods is on the rise. Cryptocurrencies provide an alternative to traditional payment systems, offering convenience, security, and financial autonomy to users.

However, the volatility of cryptocurrencies poses a challenge when it comes to their use as a stable medium of exchange. Stablecoins, which are pegged to a stable asset, aim to address this issue and provide a more reliable form of digital currency for everyday transactions.

Environmental Impact of Cryptocurrencies

One of the concerns surrounding cryptocurrencies is their environmental impact. The mining process and energy consumption associated with cryptocurrencies, particularly Bitcoin, have raised questions about their sustainability.

Bitcoin mining requires significant computational power and electricity, leading to a substantial carbon footprint. However, efforts are being made to develop more energy-efficient mining methods and promote the use of renewable energy sources in cryptocurrency mining operations.

Furthermore, the development of environmentally friendly cryptocurrencies and blockchain networks that prioritize sustainability is gaining traction. These initiatives aim to reduce the environmental impact of cryptocurrencies while still harnessing the benefits they offer.

Potential Risks and Challenges

Despite the promising future of cryptocurrencies, there are several risks and challenges that need to be addressed for their widespread adoption and stability.

Volatility: The high volatility of cryptocurrencies poses risks for investors and businesses, as prices can fluctuate significantly within short periods. Price manipulation and speculation are also concerns that need to be addressed.

Security: The decentralized nature of cryptocurrencies makes them vulnerable to hacking, fraud, and theft. Measures to enhance security and protect user funds are crucial for the long-term sustainability of cryptocurrencies.

Regulatory Uncertainty: The lack of uniform regulations across different jurisdictions creates uncertainty for businesses and investors. Clear and comprehensive regulatory frameworks are necessary to foster trust and stability in the cryptocurrency market.

Scalability: As the adoption of cryptocurrencies increases, scalability becomes a pressing issue. Blockchain networks need to accommodate high transaction volumes without compromising speed, cost, or security.

Educational Awareness: Many individuals still lack understanding and awareness of cryptocurrencies. Education and awareness initiatives are essential for widespread adoption and to dispel misconceptions surrounding digital currencies.

FAQ

Q: Will cryptocurrencies replace traditional currencies?

A: While cryptocurrencies have the potential to revolutionize the financial industry, it is unlikely that they will completely replace traditional currencies in the near future. They are more likely to coexist and complement existing systems.

Q: Are cryptocurrencies a safe investment?

A: As with any investment, cryptocurrencies come with risks. It is important to conduct thorough research, diversify your portfolio, and only invest what you can afford to lose.

Q: Can cryptocurrencies be hacked?

A: While cryptocurrencies themselves cannot be hacked, exchanges and wallets can be vulnerable to hacking. It is crucial to choose reputable platforms and utilize proper security measures to protect your digital assets.

Q: How can I start investing in cryptocurrencies?

A: To start investing in cryptocurrencies, you will need to open an account on a cryptocurrency exchange, complete the verification process, and deposit funds. It is advisable to start with a small investment and gradually learn about different cryptocurrencies and investment strategies.

Q: What are the tax implications of owning cryptocurrencies?

A: Tax regulations regarding cryptocurrencies vary from country to country. It is important to consult with a tax professional to understand your obligations and ensure compliance with the applicable tax laws.

Conclusion

In conclusion, the future of cryptocurrencies holds immense potential. With increasing adoption, technological advancements, and mainstream recognition, cryptocurrencies are set to reshape the financial landscape. However, it is essential to navigate the challenges and risks associated with this emerging industry carefully.

As an investor or enthusiast, it is crucial to stay informed, conduct thorough research, and make well-informed decisions. The world of cryptocurrencies is still evolving, and it is an exciting time to be part of this digital revolution. Embrace the opportunities, but proceed with caution.

Final Remarks

Dear Readers,

We hope you found this article on the future predictions of cryptocurrencies informative and insightful. It is important to note that the information provided is based on current trends and market analysis and should not be considered as financial advice.

As with any investment, it is advisable to consult with a financial advisor or conduct your own research before making any investment decisions. The cryptocurrency market is highly volatile and can be subject to various external factors that may impact its performance.

Thank you for joining us on this journey into the world of cryptocurrencies. We wish you success in your future endeavors.

This post topic: Blockchain Insights