Unlocking The Potential: Explore The Exciting World Of Cryptocurrency Index

Cryptocurrency Index: A Comprehensive Overview

Introduction

Welcome, Readers! Today, we delve into the fascinating world of cryptocurrency index, a valuable tool for investors and enthusiasts alike. In this article, we will explore the ins and outs of cryptocurrency index, providing you with a comprehensive understanding of its significance, benefits, and drawbacks.

3 Picture Gallery: Unlocking The Potential: Explore The Exciting World Of Cryptocurrency Index

So, what exactly is a cryptocurrency index? How does it work? Who can benefit from it? When did it emerge? Where can you find reliable cryptocurrency index data? Why should you consider investing in it? And finally, how can you effectively utilize cryptocurrency index for your investment strategies? Read on to discover the answers to these questions and more.

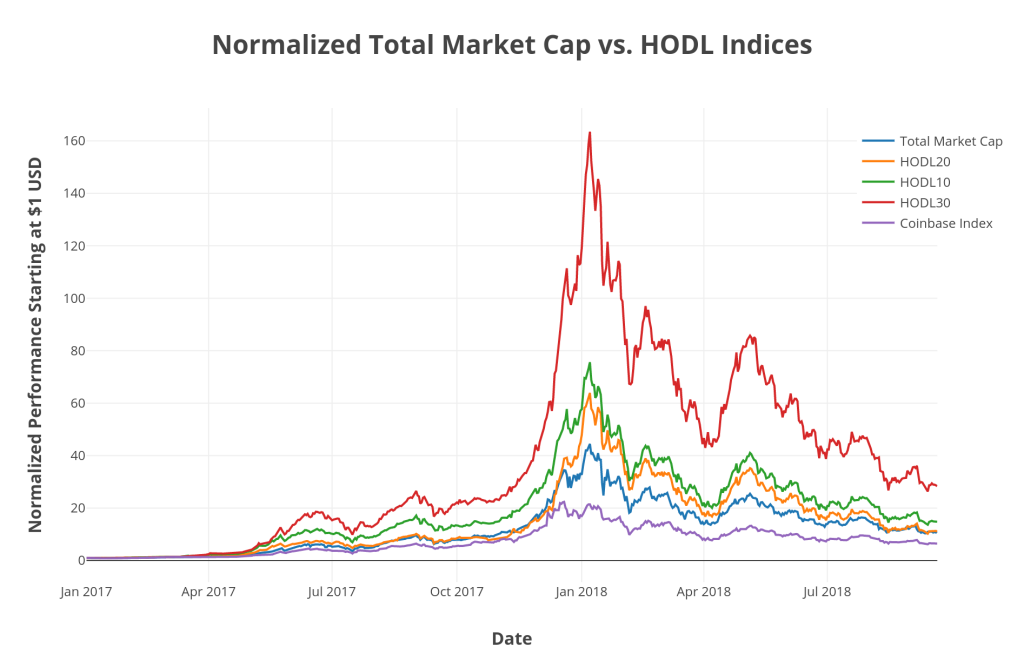

Image Source: theirrelevantinvestor.com

But first, let’s begin with the basics.

What is a Cryptocurrency Index?

Put simply, a cryptocurrency index is a curated collection of various digital currencies that are grouped together to provide an overview of the overall market performance. It serves as a benchmark, allowing investors to track the performance of the entire cryptocurrency market or specific sectors within it.

🔑 Key Points:

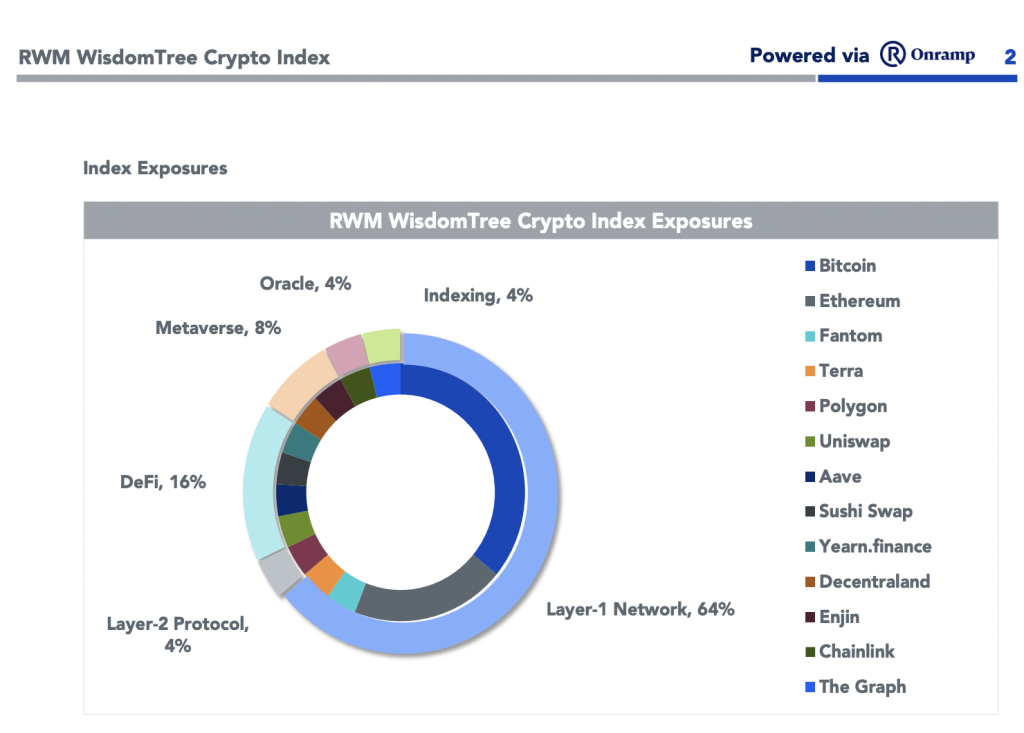

Image Source: cmcmarkets.com

A cryptocurrency index is a curated collection of digital currencies.

It serves as a benchmark for tracking market performance.

Investors can use it to gain insights into the overall market or specific sectors.

How Does a Cryptocurrency Index Work?

Cryptocurrency indices are typically calculated using a weighted average of the prices of the constituent coins or tokens. The weightings can be based on various factors, such as market capitalization, trading volume, or a combination of both.

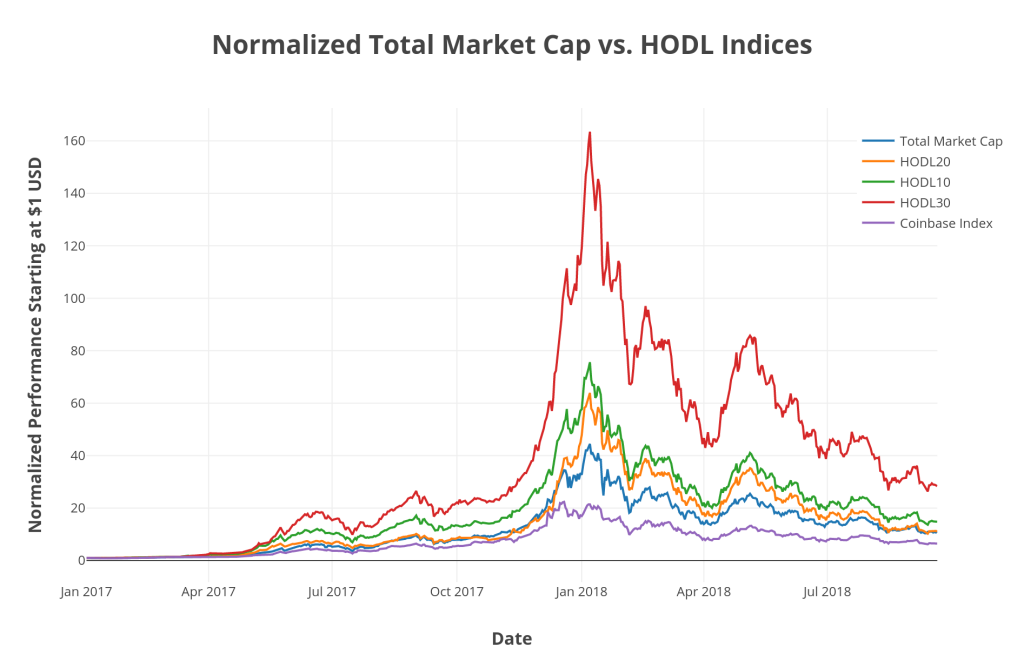

Image Source: hodlbot.io

🔑 Key Points:

Cryptocurrency indices are calculated using weighted averages.

Weightings can be based on factors like market capitalization or trading volume.

Who Can Benefit from Cryptocurrency Index?

Cryptocurrency index is a valuable tool for a wide range of individuals and entities. Investors can use it to assess the performance of their portfolios and make informed decisions. Traders can utilize the insights provided by the index to identify trends and opportunities in the market. Additionally, researchers and analysts can rely on cryptocurrency index data to conduct studies and gain a deeper understanding of the market dynamics.

🔑 Key Points:

Investors can assess portfolio performance and make informed decisions.

Traders can identify trends and opportunities in the market.

Researchers and analysts can gain insights for in-depth market studies.

When Did Cryptocurrency Index Emerge?

The concept of cryptocurrency index emerged in tandem with the growth of the digital currency market. As more cryptocurrencies gained prominence, the need for a benchmark to track their performance became evident. The first cryptocurrency index, the Crypto20 index, was launched in 2017, paving the way for others to follow suit.

🔑 Key Points:

Cryptocurrency indices emerged with the growth of the digital currency market.

The first cryptocurrency index, the Crypto20 index, was launched in 2017.

Where Can You Find Reliable Cryptocurrency Index Data?

Reliable cryptocurrency index data can be found on various platforms and websites dedicated to providing accurate and up-to-date information. Some popular sources include CoinMarketCap, CoinGecko, and Brave New Coin. It is crucial to rely on reputable sources to ensure the accuracy and reliability of the data.

🔑 Key Points:

Reliable cryptocurrency index data can be found on dedicated platforms and websites.

Popular sources include CoinMarketCap, CoinGecko, and Brave New Coin.

Ensure to rely on reputable sources for accurate and reliable data.

Why Should You Consider Investing in Cryptocurrency Index?

Investing in cryptocurrency index offers several advantages. Firstly, it provides diversification by allowing investors to gain exposure to a broad range of digital assets. This diversification helps mitigate risk and spread potential gains. Secondly, it offers convenience by simplifying the investment process, as investors can gain exposure to multiple cryptocurrencies through a single investment vehicle. Lastly, it allows for passive investing, where investors can track the market’s performance without actively managing individual assets.

However, it is crucial to consider the disadvantages as well.

🔑 Key Points:

Cryptocurrency index offers diversification and risk mitigation.

It simplifies the investment process and offers convenience.

Passive investing is possible with cryptocurrency index.

Advantages and Disadvantages of Cryptocurrency Index

Advantages of Cryptocurrency Index

1. Diversification: Cryptocurrency index provides exposure to a diversified portfolio of digital assets, reducing the impact of volatility on individual investments.

2. Risk Mitigation: By spreading investments across multiple cryptocurrencies, the risk associated with a single coin is minimized.

3. Convenience: Investors can access a diversified portfolio through a single investment vehicle, eliminating the need to manage multiple wallets and exchanges.

4. Market Insights: Cryptocurrency index offers valuable insights into market trends and performance, aiding informed investment decisions.

5. Accessibility: Cryptocurrency indices are available to both retail and institutional investors, providing equal opportunities for participation.

🔑 Key Points:

Cryptocurrency index offers diversification and risk mitigation.

It provides convenience and valuable market insights.

Indices are accessible to both retail and institutional investors.

Disadvantages of Cryptocurrency Index

1. Limited Control: Investing in cryptocurrency index means relinquishing control over individual coin selection and allocation.

2. Lack of Customization: Investors cannot tailor the index to their specific preferences or investment strategies.

3. Potential Tracking Error: There might be slight deviations between the index’s performance and the actual market due to factors like fees and rebalancing.

4. Market Dependency: The performance of cryptocurrency index is dependent on the overall market sentiment and trends.

5. Volatility: While diversification minimizes the risk, cryptocurrencies as a whole are known for their high volatility.

🔑 Key Points:

Cryptocurrency index limits control and customization.

Potential tracking error and market dependency are factors to consider.

Volatility remains a characteristic of the cryptocurrency market.

Frequently Asked Questions (FAQ)

1. What is the difference between a cryptocurrency index and a cryptocurrency exchange?

A cryptocurrency index is a benchmark that tracks the performance of a group of digital currencies. On the other hand, a cryptocurrency exchange is a platform where individuals can buy, sell, and trade digital assets.

2. Are cryptocurrency indices regulated?

Cryptocurrency indices currently lack specific regulations, which means investors should exercise caution and conduct thorough research before investing.

3. Can I invest in cryptocurrency index with a small budget?

Yes, cryptocurrency indices are often designed to accommodate investors with varying budgets. You can find indices that cater to small-scale investors.

4. Can I create my own cryptocurrency index?

Yes, it is possible to create your own cryptocurrency index using various methodologies and weightings. However, it requires extensive knowledge and expertise in the field.

5. What are the fees associated with investing in cryptocurrency index?

The fees associated with investing in cryptocurrency index can vary depending on the provider. It is essential to consider the management fees and any other associated costs before making an investment decision.

Conclusion

In conclusion, cryptocurrency index provides investors and enthusiasts with a comprehensive overview of the digital currency market. It offers diversification, convenience, and valuable market insights. However, it is essential to weigh the advantages against the disadvantages and consider personal investment objectives before making any investment decisions.

So, whether you are a seasoned investor or just starting your journey in the world of cryptocurrencies, exploring cryptocurrency index can be a valuable addition to your investment strategy. Stay informed, conduct thorough research, and make informed decisions to navigate the exciting and ever-evolving landscape of digital assets.

Final Remarks

The information provided in this article is for educational and informational purposes only. It should not be considered as financial or investment advice. Before making any investment decisions, we recommend consulting with a professional financial advisor. Investing in cryptocurrencies carries inherent risks, and individuals should exercise caution and conduct thorough research before committing any funds.

This post topic: Blockchain Insights