Unlocking Success: Power Up Your Investments With Leading Cryptocurrency Investment Companies!

Cryptocurrency Investment Companies: A Comprehensive Guide

Introduction

Dear Readers,

Welcome to this comprehensive guide on cryptocurrency investment companies. In this article, we will delve into the world of cryptocurrency investment companies, exploring what they are, who they are, when they emerged, where they operate, why they are gaining popularity, and how they work. If you are interested in the world of cryptocurrencies and considering investing, this guide is a must-read for you. So, let’s dive in and explore the exciting realm of cryptocurrency investment companies together.

3 Picture Gallery: Unlocking Success: Power Up Your Investments With Leading Cryptocurrency Investment Companies!

Table of Contents

1. Introduction

2. What Are Cryptocurrency Investment Companies?

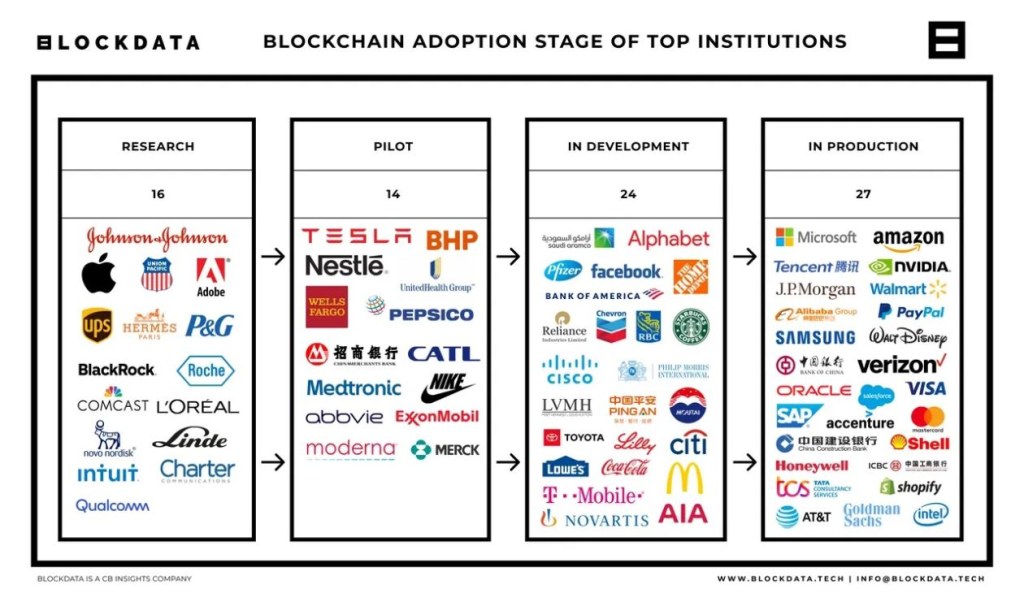

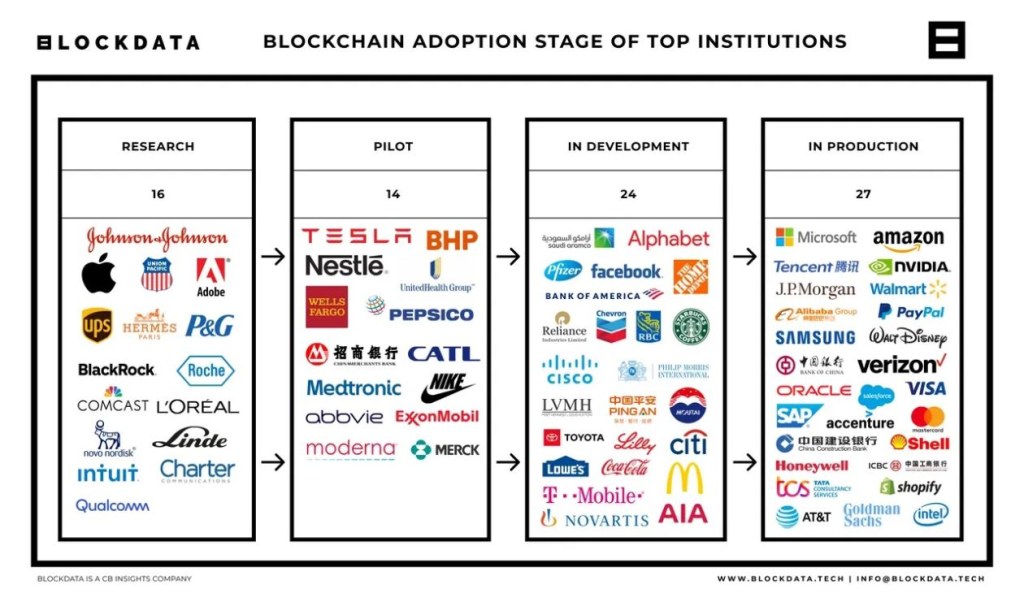

Image Source: cbinsights.com

3. Who Are the Key Players in Cryptocurrency Investment Companies?

4. When Did Cryptocurrency Investment Companies Emerge?

Image Source: cbinsights.com

5. Where Do Cryptocurrency Investment Companies Operate?

6. Why Are Cryptocurrency Investment Companies Gaining Popularity?

7. How Do Cryptocurrency Investment Companies Work?

Image Source: forkast.news

8. Advantages of Investing in Cryptocurrency Investment Companies

9. Disadvantages of Investing in Cryptocurrency Investment Companies

10. Frequently Asked Questions (FAQ)

11. Conclusion

12. Final Remarks

What Are Cryptocurrency Investment Companies?

Cryptocurrency investment companies are firms that specialize in managing cryptocurrency investments on behalf of individuals or institutions. These companies offer various services such as portfolio management, investment advice, and trading strategies to maximize profits in the volatile cryptocurrency market. By leveraging their expertise and industry knowledge, cryptocurrency investment companies aim to provide investors with opportunities to capitalize on the potential growth of cryptocurrencies.

Who Are the Key Players in Cryptocurrency Investment Companies?

In the world of cryptocurrency investment companies, there are several key players that investors should be aware of. These include:

1. Asset Managers: These professionals are responsible for managing the investment portfolios of clients, making strategic investment decisions, and monitoring the performance of different cryptocurrencies.

2. Analysts: Analysts conduct in-depth research and analysis on various cryptocurrencies, market trends, and investment opportunities. They provide valuable insights and recommendations to guide investment decisions.

3. Traders: Traders execute buy and sell orders on behalf of clients, aiming to generate profits from short-term price movements in the cryptocurrency market.

4. Compliance Officers: Compliance officers ensure that the operations of cryptocurrency investment companies comply with relevant regulations and legal requirements to protect investors’ interests.

5. Customer Support: Customer support teams assist clients with inquiries, account management, and problem resolution, ensuring a smooth and seamless experience for investors.

6. Technology Experts: Technology experts develop and maintain the platforms and systems used by cryptocurrency investment companies to facilitate investment activities and ensure security.

When Did Cryptocurrency Investment Companies Emerge?

The emergence of cryptocurrency investment companies can be traced back to the early days of cryptocurrencies, particularly with the rise of Bitcoin in 2009. As cryptocurrencies gained popularity and mainstream recognition, the demand for professional investment management services in this space increased. This led to the establishment of the first cryptocurrency investment companies, which sought to bridge the gap between traditional finance and the decentralized world of cryptocurrencies.

Where Do Cryptocurrency Investment Companies Operate?

Cryptocurrency investment companies operate globally, serving clients from various parts of the world. While some companies have physical offices in specific locations, many operate primarily online, leveraging digital platforms and technologies to provide their services to a wide range of investors. This global accessibility enables investors from different countries to take advantage of the opportunities offered by cryptocurrency investment companies.

Why Are Cryptocurrency Investment Companies Gaining Popularity?

Cryptocurrency investment companies are gaining popularity for several reasons:

1. Expertise: Cryptocurrency investment companies employ professionals with deep knowledge and experience in the cryptocurrency market. This expertise allows them to navigate the complexities of the market and make informed investment decisions.

2. Diversification: Investing in cryptocurrencies through an investment company allows for diversification across different cryptocurrencies and investment strategies. This diversification helps mitigate risks and enhances the potential for higher returns.

3. Convenience: Cryptocurrency investment companies handle the technical aspects of investing in cryptocurrencies, such as wallet management and security measures. This streamlines the investment process and provides convenience for investors.

4. Regulation and Compliance: Reputable cryptocurrency investment companies adhere to regulatory frameworks and compliance standards, providing investors with a sense of security and assurance.

5. Market Insights: Cryptocurrency investment companies have access to extensive market research and analysis, which they use to identify trends and opportunities. This enables them to make informed investment decisions and capitalize on market movements.

How Do Cryptocurrency Investment Companies Work?

Cryptocurrency investment companies typically follow a structured process:

1. Onboarding: Investors undergo a thorough onboarding process, which includes identity verification and the completion of necessary documentation.

2. Risk Assessment: Cryptocurrency investment companies assess the risk profile of investors to determine suitable investment strategies and products.

3. Portfolio Allocation: Based on the investor’s risk profile and investment objectives, cryptocurrency investment companies allocate funds across different cryptocurrencies and investment vehicles.

4. Active Management: Once the portfolio is established, cryptocurrency investment companies actively manage the investments, monitoring market conditions and making adjustments as needed.

5. Reporting and Performance: Investors receive regular reports and updates on the performance of their investments, allowing them to track progress and evaluate the effectiveness of the investment strategy.

6. Client Support: Cryptocurrency investment companies provide ongoing support to investors, addressing inquiries, providing market updates, and assisting with any issues or concerns.

Advantages of Investing in Cryptocurrency Investment Companies

Investing in cryptocurrency investment companies offers several advantages:

1. Professional Expertise: By leveraging the expertise of professionals, investors can benefit from their knowledge and experience in the cryptocurrency market.

2. Diversification: Cryptocurrency investment companies provide access to a diversified portfolio of cryptocurrencies, reducing the risk associated with investing in a single cryptocurrency.

3. Convenience: Investors can rely on cryptocurrency investment companies to handle the technical aspects of investing, such as security measures and wallet management.

4. Market Insights: Cryptocurrency investment companies have access to extensive market research and analysis, which can help investors make informed investment decisions.

5. Regulatory Compliance: Reputable cryptocurrency investment companies adhere to regulatory frameworks, providing investors with a sense of security and compliance.

Disadvantages of Investing in Cryptocurrency Investment Companies

While there are advantages, it is essential to consider the potential disadvantages of investing in cryptocurrency investment companies:

1. Volatility: The cryptocurrency market is highly volatile, and investments can be subject to significant price fluctuations.

2. Fees: Cryptocurrency investment companies often charge management fees, which can reduce the overall returns on investments.

3. Regulatory Risks: The regulatory environment surrounding cryptocurrencies is evolving, and changes in regulations can impact the operations of cryptocurrency investment companies.

4. Limited Control: Investors relinquish some control over their investments when entrusting them to a cryptocurrency investment company.

5. Market Risk: The performance of cryptocurrency investments is subject to market conditions and can be influenced by factors beyond the control of investment companies.

Frequently Asked Questions (FAQ)

1. Can I invest in cryptocurrency investment companies with a small budget?

Answer: Yes, many cryptocurrency investment companies offer investment options suitable for different budget sizes. It is advisable to research and compare different companies to find one that aligns with your budget and investment goals.

2. Are cryptocurrency investment companies regulated?

Answer: Some cryptocurrency investment companies operate under regulatory frameworks, while others may not. It is crucial to choose a reputable company that adheres to regulations to ensure the safety of your investments.

3. How long should I hold my investments in cryptocurrency investment companies?

Answer: The holding period for investments in cryptocurrency investment companies can vary based on your investment objectives and the market conditions. It is advisable to consult with professionals or financial advisors to determine an appropriate holding period.

4. Can I withdraw my investments from a cryptocurrency investment company at any time?

Answer: Withdrawal policies can differ among cryptocurrency investment companies. Some may impose restrictions or penalties for early withdrawals, while others may offer more flexible withdrawal options. It is important to review the terms and conditions before investing.

5. Are there any risks associated with investing in cryptocurrency investment companies?

Answer: Yes, investing in cryptocurrency investment companies involves risks, such as market volatility, regulatory changes, and potential loss of capital. It is essential to carefully assess the risks and consider your risk tolerance before making any investment decisions.

Conclusion

In conclusion, cryptocurrency investment companies offer investors an opportunity to navigate the complex world of cryptocurrencies with professional expertise, diversification, convenience, and access to market insights. While there are advantages and disadvantages to investing in these companies, thorough research and careful consideration can help investors make informed decisions. Remember to choose reputable companies that align with your investment goals and risk tolerance. Happy investing!

Final Remarks

Dear Readers,

Investing in cryptocurrency investment companies can be a rewarding endeavor, but it comes with risks. It is important to conduct thorough research, seek professional advice, and carefully consider your investment goals and risk tolerance before making any investment decisions. This article is intended for informational purposes only and should not be construed as financial advice. The cryptocurrency market is highly volatile, and investments can result in significant losses. Please invest responsibly and only what you can afford to lose. Remember, cryptocurrencies are still a relatively new and evolving asset class, and market conditions can change rapidly. Stay informed, stay vigilant, and happy investing!

This post topic: Blockchain Insights